Big changes are coming for U.S. employers in 2026 and the One Big Beautiful Bill Act is leading the charge. Not sure how to stay compliant? Discover how CloudApper hrPad makes OBBBA compliance simple with smart time tracking, accurate wage reporting, and zero manual headaches.

Table of Contents

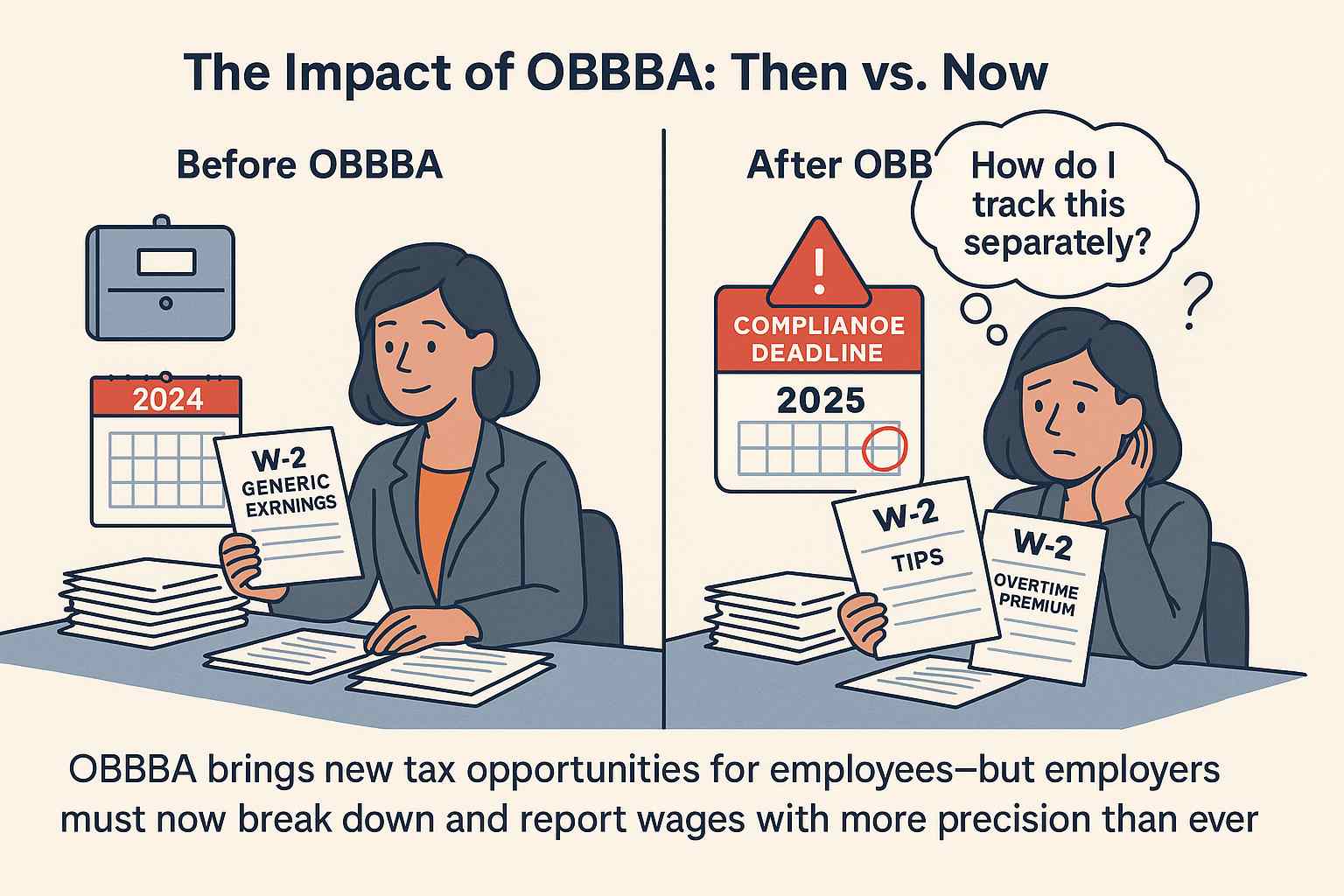

If you’re running a business in the U.S., you’ve likely heard about the One Big Beautiful Bill Act (OBBBA). It’s one of the biggest compliance shake-ups in recent years, officially taking effect on January 1, 2025. While the bill offers new tax deductions for employees covering qualifying tips and overtime premiums it also creates strict OBBBA compliance requirements for employers. From tracking pay types more precisely to updating how wages are reported on W-2s, OBBBA compliance is now a critical priority for any business with hourly or tipped workers.

For more information on CloudApper hrPad visit our page here.

Starting January 1, 2025, businesses must clearly separate qualifying tips from non-qualifying ones. They must also identify and report overtime premiums apart from regular wages. These changes affect how employers track time, process payroll, and file W-2 forms.

“The legislation reflects a growing trend toward wage transparency,” says Sarah L., a labor compliance advisor. “It’s good for employees, but businesses need to prepare now.”

On the surface, the bill is good news for employees—it allows them to deduct qualified tips and overtime premiums from their federal taxable income. But for employers, it introduces a wave of new responsibilities that require tighter time tracking, wage classification, and accurate payroll reporting.

The truth is, most businesses simply aren’t ready. But CloudApper hrPad is.

Why the OBBBA Matters to Employers

The heart of this legislation lies in the details. Employers will now be required to clearly distinguish between qualified tips and non-qualified earnings. The same applies to overtime. Only certain types of overtime premiums qualify under the new rules, and lumping everything into one bucket (like many systems do) just won’t cut it anymore.

To make matters more complex, all of this has to be reflected in your W-2 reporting starting with 2025 wages. That means systems need to track and categorize pay in real time—and store that information securely for audits or employee disputes.

And let’s be honest: most payroll platforms weren’t built with this level of wage granularity in mind.

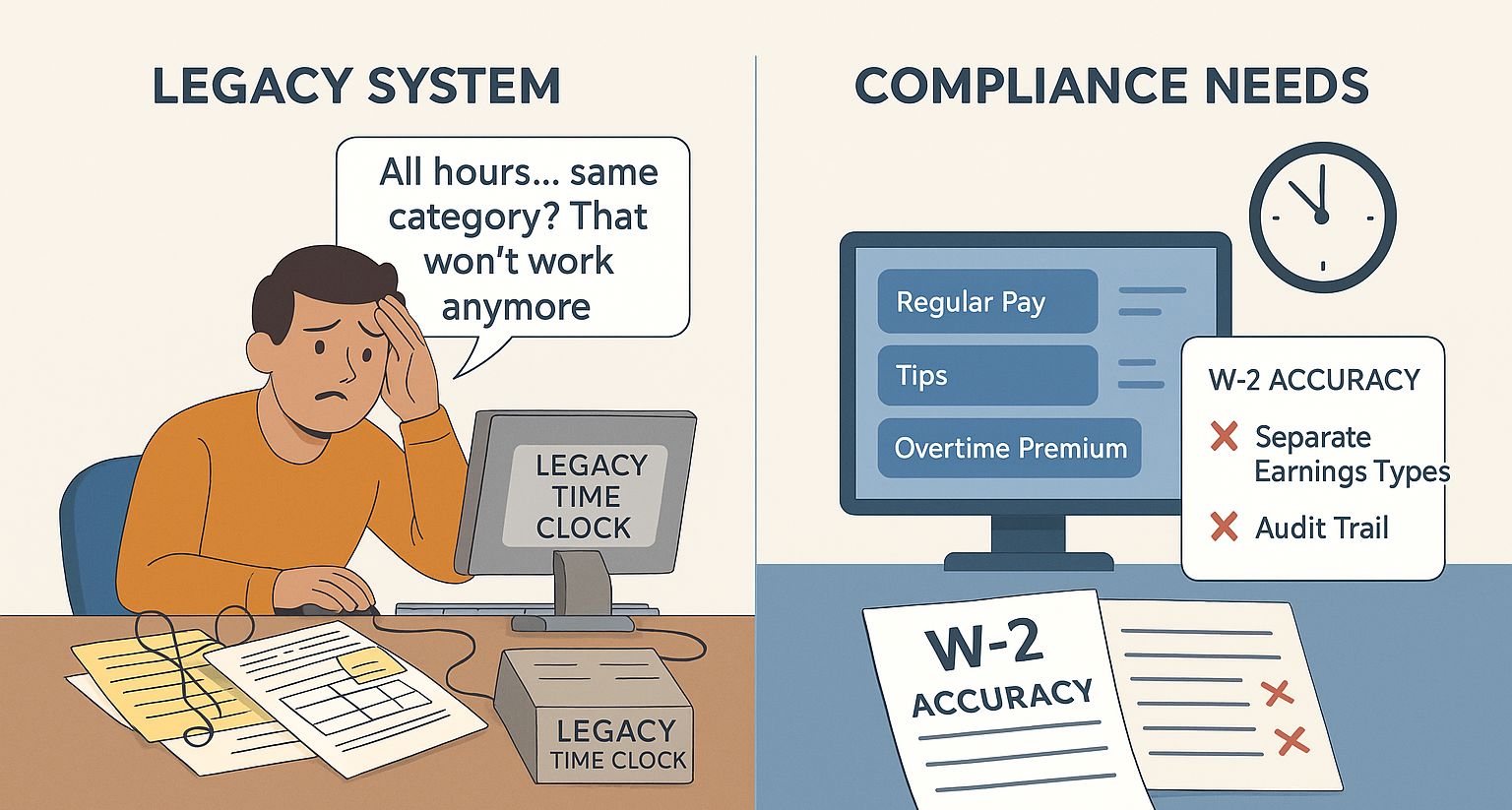

The Problem With Legacy Systems

Many businesses still rely on outdated time clocks or systems that treat all hours and earnings the same way. They’re fine for basic tracking—but when it comes to compliance, they leave huge gaps.

Even well-meaning HR teams end up spending hours manually cleaning up data just to stay somewhat compliant. That’s a massive time sink, and it leaves plenty of room for errors.

As compliance expert Mark Jennings puts it, “Legacy systems weren’t designed for this level of wage classification. Trying to retrofit them usually causes more problems than it solves.”

How CloudApper hrPad Solves the Compliance Challenge

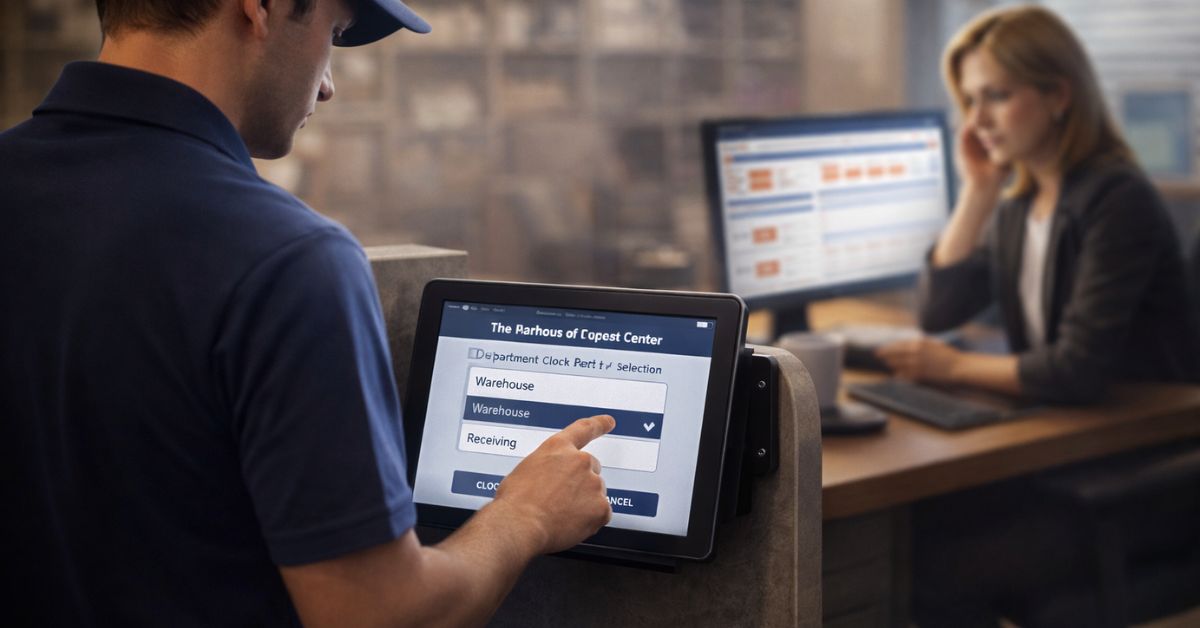

This is exactly the kind of situation CloudApper hrPad was built for. It’s a tablet-based, AI-powered HR assistant that plugs into your existing platforms—whether that’s UKG, Workday, ADP, or something else.

What makes it stand out is how it handles wage classification at the point of entry. When employees clock in or out, hrPad can tag their time according to your specific business rules. Tips, overtime premiums, regular pay—it all gets tracked and categorized in real time. No manual rework. No post-payroll cleanup.

That means when it’s time to file W-2s, everything’s already formatted the way it needs to be.

Compliance Features That Actually Work for You

hrPad also helps with compliance prompts. For example, if you’re operating in California or New York, it can ask employees to confirm whether they took their meal or rest breaks when clocking out. If someone reports an issue, it’s documented instantly. That kind of automation not only protects your business—it strengthens your legal position if problems arise later.

And when it comes to time theft? hrPad supports secure clock-ins using facial recognition, QR codes, or PINs. That means no more buddy punching or guesswork around hours worked.

Trusted by Compliance-Focused Employers

Companies like Applegreen and Classic Collision are already seeing the benefits. Applegreen used hrPad to stay on top of youth labor laws, especially around breaks for minor workers. Classic Collision rolled it out across multiple states to streamline PTO, time tracking, and reduce payroll errors—without overloading their HR team.

In both cases, they replaced manual, error-prone workflows with something faster, smarter, and fully compliant.

Looking Ahead to 2025

The OBBBA isn’t something you can afford to put off. While the bill becomes active in 2025, the data you collect starting January 1 will directly affect your reporting for the following year. That means any delay in upgrading your systems puts you at risk for non-compliance—and the consequences that come with it.

hrPad takes the pressure off your team and gives you a solution that’s already aligned with the new rules. You don’t need to overhaul your entire payroll system. You just need a smarter front-end that makes compliance automatic—and that’s exactly what CloudApper hrPad delivers.

Final Thoughts

Labor laws are evolving, and the One Big Beautiful Bill Act is just the beginning. Businesses that take action now will be in a much stronger position next year—both financially and operationally.

CloudApper hrPad gives you the visibility, structure, and control you need to stay compliant without the stress. And for many businesses, that peace of mind is long overdue.

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

Brochure

CloudApper hrPad

Empower Frontline Employees with an AI-Powered Tablet/iPad Solution

Download Brochure

CloudApper AI Solutions for HR

- Works with

- and more.

Similar Posts

Driving Frontline Inclusion: Bilingual HR Policy Access with CloudApper hrPad

Solving the Deskless Divide: How Frontline-First HR Design Empowers the…

![Stay Compliant in [current-year] With U.S. Labor Laws Under the One Big Beautiful Bill Act(OBBBA) Using CloudApper hrPad](https://www.cloudapper.ai/wp-content/uploads/2025/12/Stay-Compliant-in-current-year-With-U.S.-Labor-Laws-Under-the-One-Big-Beautiful-Bill-ActOBBBA-Using-CloudApper-hrPad-1200x800.jpg)