Managing minimum wage compliance across multiple states has become increasingly complex as cities and states introduce their own wage rules. For organizations with distributed workforces, staying compliant now requires smarter tools that adapt to local laws without adding operational burden.

Table of Contents

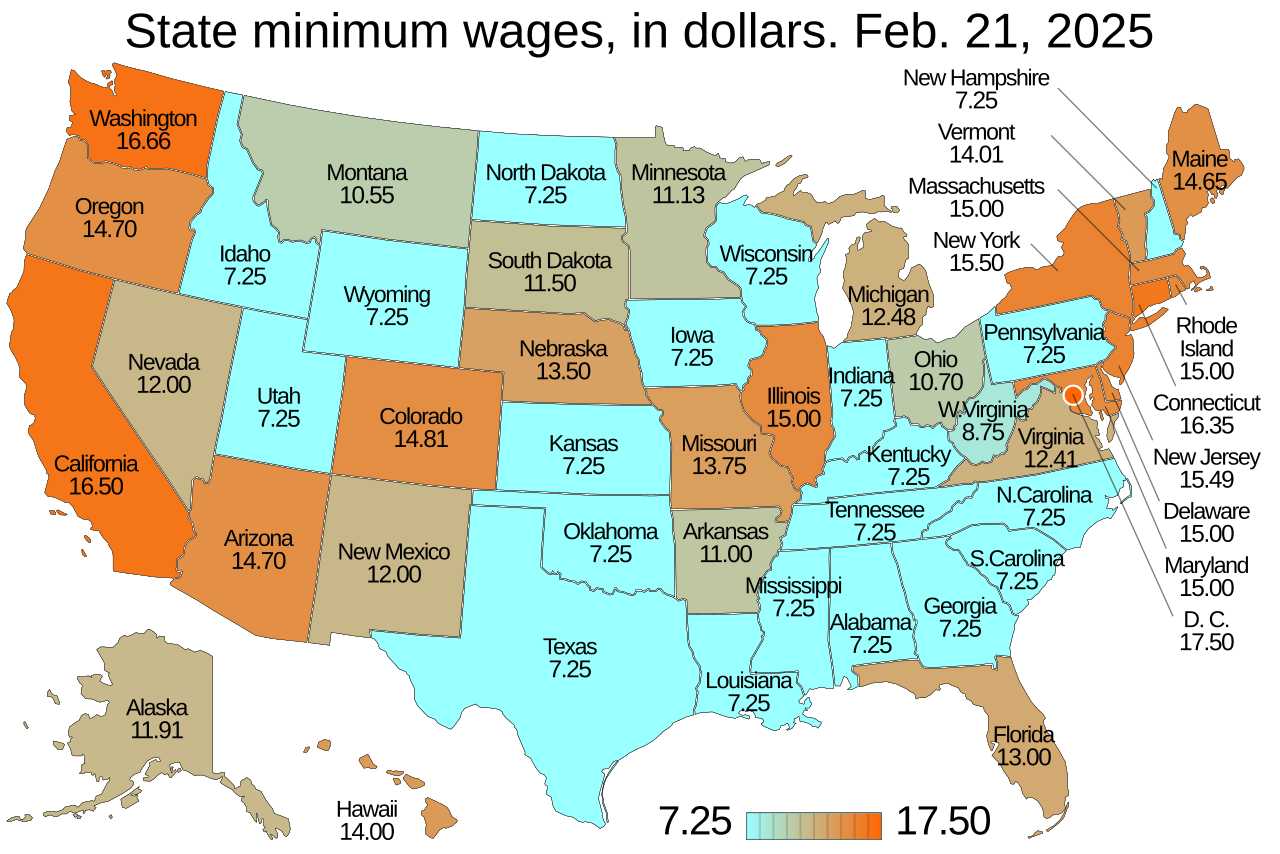

As we approach 2026, managing minimum wage compliance has become significantly more complex for employers with multi-location workforces. More than 30 U.S. states and hundreds of cities now enforce their own wage ordinances, many of which change annually or even mid-year.

For more information on CloudApper hrPad visit our page here.

For HR, payroll, and workforce leaders, this creates constant pressure to stay compliant, reduce legal risk, and control labor costs without slowing down operations.

For organizations struggling with Multi-State Minimum Wage Laws Management, CloudApper hrPad is emerging as a practical, compliance-focused solution.

The Fragmented Landscape of Wage Laws

In 2026, there is no single “national standard” for minimum wage compliance.

Across the U.S., wage and labor rules vary sharply by location and worker type:

-

California enforces multiple city-level minimum wages that exceed the state rate

-

Cities like Seattle, Boulder, and Washington, D.C. have wage floors approaching or exceeding $20 per hour

-

Tipped wage rules differ widely across states and municipalities

-

Break and scheduling requirements for minors and shift-based workers change by locality

For organizations operating across dozens or even hundreds of locations, manually tracking and applying these rules is inefficient and increasingly risky. One missed update or misapplied rule can trigger compliance violations.

Statewide Minimum Wage Updates Effective January 1, 2026

The table below highlights statewide minimum wage increases effective January 1, 2026. Keep in mind that many cities and counties enforce higher local rates, so employers must always validate wage rules based on the employee’s actual work location.

| State | 2026 State Minimum Wage (per hour) | Tipped Wage (if applicable) | Notes |

|---|---|---|---|

| Arizona | $15.15 | $12.15 | Indexed annual increase |

| California | $16.90 | No tip credit | City rates often higher |

| Colorado | $15.16 | $12.14 | Adjusted annually |

| Connecticut | $16.94 | Varies by role | Scheduled increase |

| Hawaii | $16.00 | $14.75 | Phased increase |

| Maine | $15.10 | $7.55 | Indexed to inflation |

| Michigan | $13.73 | $5.49 | Gradual increase |

| Minnesota | $11.41 | No tip credit | Large employer rate |

| Missouri | $15.00 | Not specified | Voter-approved increase |

| Montana | $10.85 | Not specified | Applies to larger employers |

| Nebraska | $15.00 | $2.13 | Multi-year increase plan |

| New Jersey | $15.92 | $6.05 | Large employer rate |

| New York | $16.00 | Varies | Regional wage structure |

| Ohio | $11.00 | $5.50 | Applies to larger employers |

| Rhode Island | $16.00 | $3.89 | Phased increase |

| South Dakota | $11.85 | $5.93 | Indexed annually |

| Virginia | $12.77 | $2.13 | Federal tipped baseline |

| Vermont | $14.42 | $7.21 | Indexed increase |

| Washington | $17.13 | No tip credit | Highest statewide rate |

Why This Table Matters for Multi-Location Employers

This chart illustrates why Multi-State Minimum Wage Laws Management has become so challenging. Even at the state level, wage rates vary widely, and they often change automatically each year. When city and county ordinances are layered on top, manual tracking becomes unsustainable for organizations operating across multiple jurisdictions.

This is exactly where automated, location-aware workforce tools become essential.

The Real Cost of Non-Compliance

Non-compliance with local wage and labor laws is no longer a theoretical risk. It carries measurable financial consequences.

-

Walmart paid $172 million in penalties related to meal break violations

-

Bank of America settled for $73 million over rest break compliance issues

-

Smaller multi-location businesses now face frequent audits and back-wage claims from local agencies

At this scale, Multi-State Minimum Wage Laws Management is no longer just an HR or payroll task. It has become a core compliance and risk-management function.

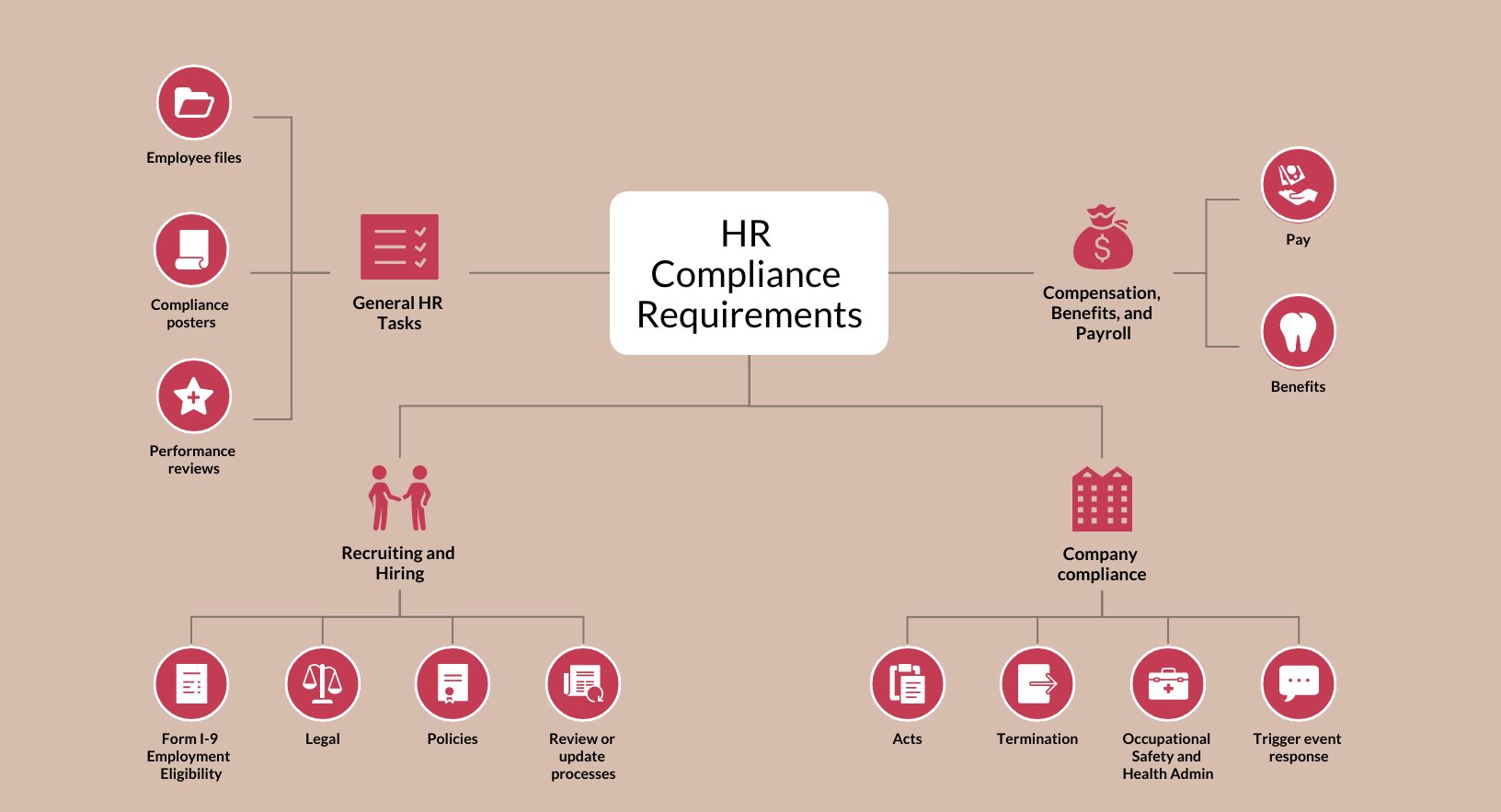

How CloudApper hrPad Addresses Multi-State Wage Complexity

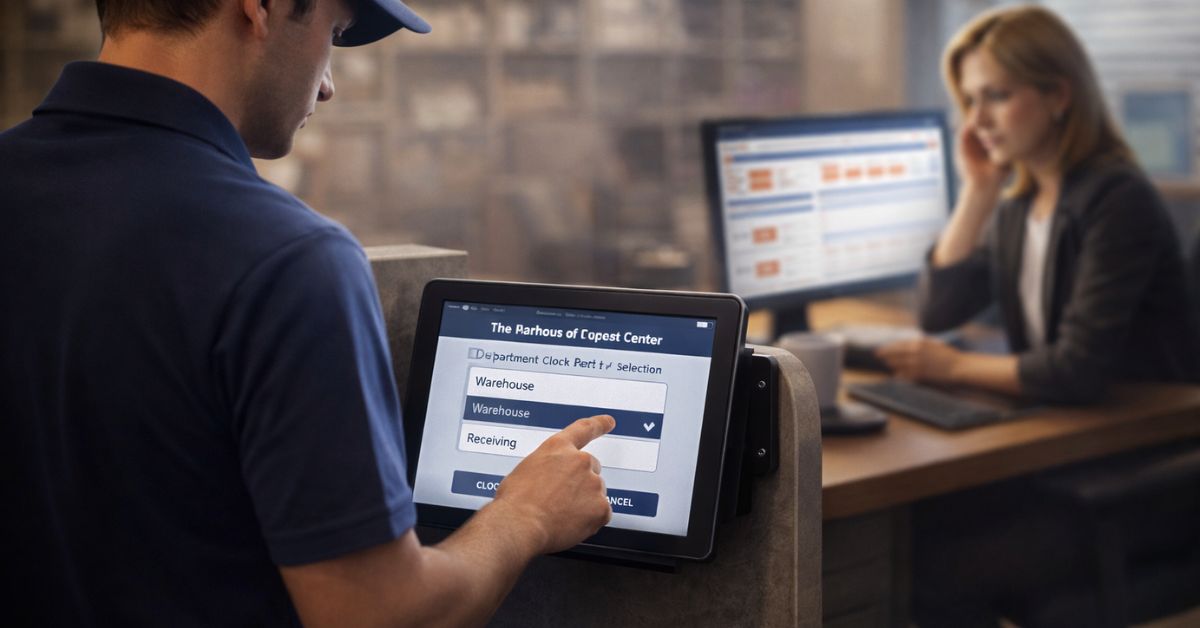

CloudApper hrPad is a tablet-based time and workforce compliance solution designed to work alongside HCM platforms such as UKG and Workday. It is particularly effective in frontline and compliance-heavy environments where location-specific rules matter.

Localized Time and Wage Rules

hrPad allows organizations to configure wage and labor rules based on job location. Minimum wage rates, break requirements, overtime thresholds, and minor labor restrictions can all be applied automatically when employees clock in or out.

Because rules are tied to the worksite, calculations remain accurate even when employees move between locations. This removes the need for manual adjustments and reduces the risk of missed updates.

Built-In Attestations for Break Compliance

With meal and rest break rules varying widely by city and state, documentation is critical.

hrPad enables custom survey questions at clock-out, such as confirming whether required breaks were taken. Each response is time-stamped and securely stored, creating a reliable audit trail that can be used during internal reviews or external investigations.

Seamless Integration with Existing HCM Systems

hrPad is not a replacement for your HCM. It extends it.

The platform integrates with systems like UKG Pro WFM (Dimensions) and Workday, feeding back compliance-ready time data including:

-

Labor transfers

-

Attestations and exceptions

-

Timecard approvals

-

Accruals and PTO data

Because hrPad runs on standard iOS and Android tablets, organizations avoid the cost and rigidity of proprietary hardware.

Real-Time Alerts and Preventive Controls

Instead of discovering issues after payroll runs, hrPad helps prevent violations in real time.

If a scheduled shift violates local labor rules or a wage threshold is not met, managers can receive immediate notifications. This allows teams to correct issues before they become compliance failures.

Why This Matters More in 2026

With ongoing legislative changes at the city and state level, relying on outdated time clocks or uniform payroll rules is no longer sustainable. Organizations must be able to:

-

Adapt quickly to city-level wage changes

-

Maintain audit-ready documentation

-

Reduce legal exposure without adding operational burden

CloudApper hrPad provides the flexibility and automation required to manage wage compliance across multiple jurisdictions without disrupting daily operations.

Final Thoughts

For organizations operating across multiple states or cities, effective Multi-State Minimum Wage Laws Management is now mission-critical.

CloudApper hrPad does more than track time. It helps ensure that workforce practices align with local wage and labor laws, reducing compliance risk while improving operational efficiency.

As 2026 approaches, the cost of relying on inflexible or outdated systems continues to rise. Modern compliance requires tools built for local complexity, not one-size-fits-all solutions.

Transform Your Employee Experience With AI Tools for hrPad

Employee Self-Service tools to automate accessibility and time management.

Learn more | Download BrochureFrequently Asked Questions

-

What are multi-state minimum wage laws?

Multi-state minimum wage laws refer to the different wage, break, and labor requirements set by states and cities that apply to employees based on where they work. -

Why is managing minimum wage compliance so difficult in 2026?

Wage rules now change at the city and state level, often mid-year, making manual tracking risky for organizations operating across multiple locations. -

How does CloudApper hrPad support wage compliance?

hrPad applies location-based wage and labor rules automatically when employees clock in or out, reducing errors and manual adjustments. -

Can hrPad integrate with existing HCM systems?

Yes. CloudApper hrPad integrates with platforms like UKG Pro WFM (Dimensions) and Workday, feeding compliance-ready time data directly into your system. -

Does hrPad help with audits and legal documentation?

hrPad securely stores time-stamped attestations and time data, helping organizations maintain clear records for audits or labor disputes.

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

Brochure

CloudApper hrPad

Empower Frontline Employees with an AI-Powered Tablet/iPad Solution

Download Brochure

CloudApper AI Solutions for HR

- Works with

- and more.

Similar Posts

Driving Frontline Inclusion: Bilingual HR Policy Access with CloudApper hrPad

Solving the Deskless Divide: How Frontline-First HR Design Empowers the…