Ensure compliance with US labor laws by using CloudApper AI TimeClock for precise time tracking. Stay within federal and state regulations effortlessly while enhancing efficiency and minimizing errors in your workforce management.

Table of Contents

As an employer, it is very important that you follow all federal and state labor laws and rules. Few of these important rules are as important as those about time and attendance. In this article, we’ll talk about the most important parts of making sure you follow US labor laws about timekeeping and how new solutions like CloudApper AI TimeClock can make the process easier and help you avoid penalties and fines.

For more information on CloudApper AI TimeClock visit our page here.

Federal Time Tracking Laws

It is very important to follow federal labor laws, like the Fair Labor Standards Act (FLSA), which is a key part of protecting employee rights. Even though the FLSA doesn’t say how to keep track of and manage employee hours, it does have rules for hourly, paid, and non-exempt workers.

CloudApper AI TimeClock ensures compliance with FLSA requirements, helping employers maintain accurate records and avoid costly fines.

The FLSA says that companies must keep track of their workers’ hours, no matter how they are classified. These records should include daily work hours, clock-in and clock-out times, break times, overtime, pay paid, and other job conditions. If FLSA time tracking rules aren’t followed, fines and fees can be very expensive, so it’s important to set up a solid way to record this information.

Time Tracking for Hourly Employees

Different states may have different rules and laws for keeping track of time, but all hourly workers in the US must meet the following government requirements:

Detailed Records: Employers must keep notes of when each workday starts and ends, as well as the total number of hours worked each week.

Payment for All Hours: Hourly workers must be paid for all hours worked, and they can’t work “off the clock.”

Round-Up Rule: Under the 7-minute rule, clock-in and clock-out times are rounded to the nearest quarter-hour. Many apps and tools that track employee time automatically follow this rule.

Modifying Time Cards: Employers can change a worker’s time card as long as all hours worked are paid for.

Overtime Compensation: If a wage worker who is not exempt works more than 40 hours in a week, they must be paid 1.5 times what they normally make.

CloudApper AI TimeClock adapts to state-specific time tracking regulations, simplifying compliance while maintaining precision.

Time Clock Rules for Overtime-Exempt Employees

Not all workers can get paid extra for working late. Under the Fair Labor Standards Act (FLSA), an employee is exempt from overtime if they meet certain requirements, such as being paid and doing certain tasks at work.

Here’s how the rules for tracking time are different for paid workers who are free from overtime:

Guaranteed Pay: Salaried workers get their base pay no matter how many hours they work each week.

Duty Completion: Employees who get paid a salary are supposed to do their jobs, no matter how long it takes

Absence Deductions: For paid workers, employers can’t take money out of their paychecks for missing part of a day.

Overtime Pay: Employees who are free from taxes do not get overtime pay.

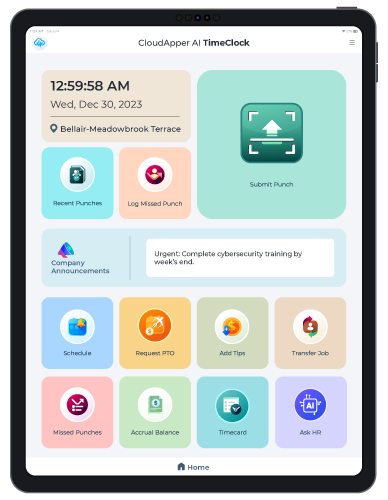

CloudApper AI Time Clock

R.D. Offutt Farms use CloudApper AI TimeClock's Barcode/QR Code Solution for Employee Time Capture

Compliance with DCAA Timekeeping Requirements

The Defense Contract Audit Agency (DCAA) makes sure that businesses with government contracts follow strict rules about keeping track of time. The DCAA makes sure that money from government contracts is spent correctly and openly.

DCAA regulations mandate that businesses:

- Establish a time-off policy.

- Keep employees informed about this policy.

- Track time on a daily basis.

- Provide accurate reports.

- Approve time tracking information.

- Maintain detailed records.

- Document any changes made.

If you don’t follow DCAA rules, you could get fined a lot and lose future chances with the Department of Defense.

State Laws on Time Tracking

In addition to federal laws, businesses must also take into account state and local rules about tracking time and attendance. Different states have different rules, like which language is preferred for keeping records or how extra pay is calculated.

For instance:

- California allows the use of paper records but requires maintenance in English and ink.

- Washington mandates 1.5 times pay for non-exempt employees working over 40 hours.

- Texas follows specific payday laws, allowing employers to use time clocks or time sheets for record-keeping.

- Michigan demands detailed records with daily hours worked, accurate to the nearest tenth of an hour or less.

CloudApper AI TimeClock streamlines time tracking, minimizing errors, simplifying payroll, and enhancing overall business efficiency.

Employee Time Tracking Software

Even though federal law doesn’t require time clocks or software for tracking employee time, many companies choose to use them to make time tracking easier and make sure they meet FLSA standards for keeping records. Using apps or automatic methods to track time has several advantages:

- Empower managers and employees to track and manage workloads effectively.

- Simplify payroll processes, minimizing errors.

- Enhance employee schedules for increased efficiency.

- Offer real-time insights into attendance and performance.

- Facilitate remote employee time tracking.

- Ensure compliance with federal regulations, including rounding up and overtime calculations.

In short, it is important for companies of all kinds to follow US labor laws and rules about timekeeping. Using effective time tracking tools like CloudApper AI TimeClock not only makes compliance easier, but also makes your company more efficient and accurate as a whole.

Make sure your business follows the rules about timekeeping and look into the benefits of software that tracks staff time today.

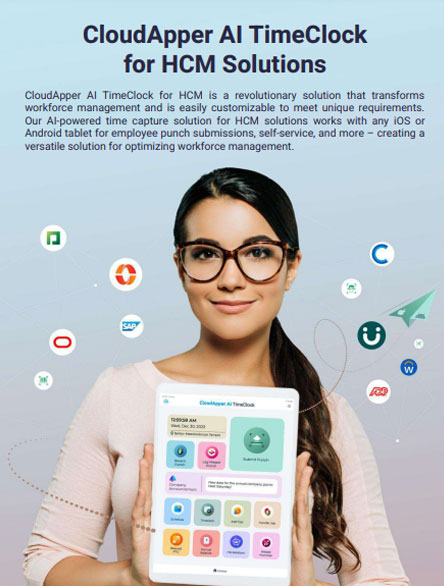

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

Brochure

CloudApper AI TimeClock

For accurate & touchless time capture experience.

Download Brochure

CloudApper AI Solutions for HR

- Works with

- and more.

Similar Posts

Time Clock Compliance: How to Avoid Costly Fines and Lawsuits…