Generative AI is transforming finance operations by automating repetitive tasks, enhancing accuracy, and providing advanced analysis. CloudApper’s Generative AI streamlines document analysis, improves collaboration, and ensures compliance, driving efficiency and innovation in financial decision-making and management.

Table of Contents

The rapid evolution of the financial ecosystem has spurred a demand for enhanced operational efficiency, prompting financial leaders to explore innovative tools and solutions. Among these, Generative AI, a revolutionary branch of artificial intelligence, is emerging as a game-changer for finance operations. From automating repetitive tasks to unlocking valuable insights, Generative AI empowers finance teams to focus on strategic decision-making and innovation.

Benefits of Generative AI in Finance Operations:

Automation and Efficiency: Generative AI automates repetitive tasks like data entry and report generation, freeing finance professionals to focus on strategic decision-making. It enhances operational efficiency by handling large datasets and performing complex calculations quickly and accurately.

Accuracy and Risk Management: AI reduces human errors in financial operations, ensuring precise calculations and compliance. It also aids in risk management by identifying anomalies and potential issues in real time, strengthening governance.

Advanced Analysis and Forecasting: With the ability to analyze vast datasets, Generative AI delivers actionable insights, helping finance teams identify trends and make data-driven decisions. Its forecasting capabilities allow for better planning through accurate projections and scenario simulations.

Cost Savings and Scalability: Automating tasks reduces operational costs, while Generative AI’s scalability ensures it can handle growing data and complexity as businesses expand.

Enhanced Customer Experience: Generative AI accelerates transaction processing, reducing response times and improving accuracy, which leads to higher customer satisfaction.

Generative AI in Finance Operations: Key Use Cases

Generative AI is transforming finance operations by streamlining and automating various processes. Here are the key areas where it’s making an impact:

Financial Planning and Budgeting: Generative AI automates financial modeling, scenario simulations, and forecasting by analyzing historical data and market trends. This enables more accurate financial planning and resource allocation.

Tax and Expense Management: By automating tax calculations and expense categorization, Generative AI ensures compliance with regulations, identifies tax-saving opportunities, and optimizes spending to improve cost control.

Financial Reporting and Risk Management: Generative AI enhances financial reporting by automating data extraction and report generation. It also strengthens risk management through real-time analysis of market trends, detecting anomalies, and suggesting mitigation strategies.

Audit and Compliance: AI assists in audit procedures by identifying fraud patterns, ensuring regulatory compliance, and monitoring financial transactions for anomalies, making audit processes more efficient and reliable.

Financial Automation: Routine finance processes such as invoice processing, reconciliation, and financial statement preparation are automated, reducing manual effort and errors, while improving speed and accuracy.

CloudApper Generative AI For Finance

CloudApper’s generative AI is positioned as a transformative tool for finance teams. Offering accurate financial analysis and forecasting, smarter document analysis, streamlined collaboration, improved financial performance, and enhanced compliance management, it unlocks the power of Generative AI in finance operations.

Accurate Financial Analysis

Leveraging generative AI, CloudApper AI captures complex patterns and relationships from financial data, providing accurate analysis for better financial planning and strategy.

Smarter Document Analysis

CloudApper AI’s work assistant streamlines document analysis, extracting accurate information from diverse financial documents, facilitating efficient analysis, and enabling quick data-driven decisions.

Streamlined Collaboration for Faster Responses

CloudApper AI’s work assistant acts as a facilitator for collaboration, sharing financial data and managing workflows across the organization. It ensures faster responses and improved collaboration through real-time information access.

Improved Financial Performance

CloudApper AI’s work assistant offers insights into financial performance analysis, expense tracking, and more. It enables continuous improvement and growth through access to financial training and coaching resources.

Enhanced Compliance Management

Addressing compliance requirements, CloudApper AI’s work assistant detects potential issues, alerts the finance team, and guides resolving them, ensuring proactive compliance and avoidance of penalties.

Conclusion

While Generative AI holds immense potential for transforming finance operations, its implementation comes with challenges. CloudApper’s generative AI emerges as a key player, offering transformative capabilities that empower finance professionals. Through accurate financial analysis, streamlined collaboration, and enhanced compliance management, CloudApper AI positions itself at the forefront of the Generative AI revolution, driving efficiency, innovation, and growth in finance operations.

In conclusion, as enterprise AI solutions embrace Generative AI, they pave the way for a new era in finance operations, where human expertise combines with advanced AI capabilities to create a synergistic force for success. The journey toward unlocking the full potential of Generative AI in finance operations is not without challenges, but with the right approach and tools, organizations can revolutionize their financial landscape and achieve unprecedented efficiency and accuracy.

- Generative AI automates repetitive tasks in finance, improving operational efficiency and enabling strategic decision-making.

- AI enhances accuracy and risk management by reducing human errors, identifying anomalies, and ensuring compliance.

- Generative AI delivers advanced analysis, helping finance teams with data-driven decision-making, forecasting, and scenario simulations.

- CloudApper Generative AI streamlines document analysis, financial performance tracking, collaboration, and compliance management.

- Generative AI is revolutionizing finance operations by driving efficiency, innovation, and growth while addressing challenges in implementation.

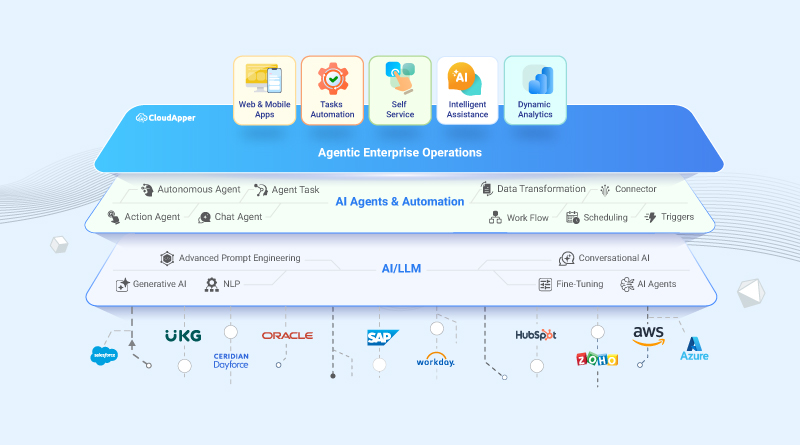

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

CloudApper AI Solutions

- Works with

- and more.

Similar Posts

What Experts Say About Enterprise Business Automation & Why You…

Enterprise Automation with AI: How to Streamline Your Business Operations