By enhancing customer service and workforce management, AI is transforming the banking industry. AI assistant creation is made easier with CloudApper AI's bespoke platform. It guarantees a smooth ride through model optimization and UX design. Working together, AI and humans improve processes, paving the way for a tech-driven future in banking.

Table of Contents

The incorporation of enterprise AI solutions and other cutting-edge technologies has led to a dramatic shift in the banking and financial sector in recent years. Not that long ago, even something as essential as opening a bank account was a time-consuming ordeal full of standing in line, filling out paper forms, and hoping for a response. However, the development of AI has transformed these procedures, making them more rapid, efficient, and available via internet platforms from any location.

The Impact on Customer Service

Improvements in customer care, enabled by AI-powered chatbots and virtual assistants, have been one of the most noticeable shifts in the banking industry. Interactions with customers are improved by these smart machines’ ability to respond instantly to questions and deliver tailored information. Customers are no longer subjected to interminable delays on hold; instead, they receive instant, hassle-free assistance, which raises satisfaction levels all around.

The Impact on Workforce Management

Financial organizations confront new difficulties and possibilities in human resource management as AI continues to transform banking operations. Companies need to find a happy medium between fully automated procedures and those requiring human oversight so that AI may be used to its full potential in simplifying both customer-facing and internal operations. The World Economic Forum projects that by 2025, 50% of all employees would need reskilling owing to the increased deployment of technology. As a result, it’s more important than ever for banking and finance institutions to train their staff to adapt to new challenges.

Ensuring Optimal Human-AI Collaboration

Even though AI may streamline and improve operational procedures, it is still important to have a sufficient amount of human oversight. Combining AI resources with human knowledge maximizes the effectiveness of both, allowing for better solutions to difficult problems and better support for customers. This collaborative approach allows employees to focus on activities that demand critical thinking and creativity, eventually leading to greater customer experiences and higher productivity.

The Role of AI in Talent Acquisition and Recruitment

The effects of AI go beyond the operational sphere and into the realm of human resources. The use of AI to aid in the hiring process is revolutionizing human resource management in the banking industry. The recruiting process may be streamlined with the use of automated systems that help find and evaluate prospects, and employees can be better prepared to meet the industry’s changing needs.

The CloudApper AI Advantage

CloudApper AI provides a powerful platform for developing AI assistants and chatbots, making it ideal for companies who wish to leverage AI in the banking and financial sectors. The first step in creating custom AI solutions is as easy as getting in touch with CloudApper’s solution specialists. Experts fine-tune the AI model, making sure it meets the specific needs of the banking industry while also taking precautions to protect customers’ personal information.

The Step-by-Step Process of building and AI Assistant for Banking and Finance

Model Tuning and Privacy Arrangements

CloudApper AI specialists fine-tune the AI model to align it with the specific demands of the banking and finance sector. Privacy arrangements are made to ensure the confidentiality of corporate data, a critical consideration in the highly regulated financial industry.

Automating Data Training

Loading corporate data into the CloudApper AI platform allows for the automatic training of the AI/LLM. This step enhances the AI assistant’s understanding of the sector’s complexities, ensuring it can effectively address customer inquiries and streamline internal processes.

User Experience Design

CloudApper AI simplifies the process of defining the user experience with a drag-and-drop designer. This user-friendly approach allows financial institutions to customize the AI assistant’s interface effortlessly, ensuring it aligns with brand identity and customer expectations.

Instant Deployment

With the data trained and the user experience designed, CloudApper AI’s platform instantaneously builds the AI assistant. This ready-to-deploy assistant seamlessly integrates with existing enterprise solutions, enhancing them with AI capabilities.

Versatility in Application

The AI assistant can be embedded on the organization’s website using a simple HTML code, facilitating real-time interaction with customers. Moreover, CloudApper AI enables the creation of entire applications within minutes, addressing diverse customer queries, automating tasks, and facilitating request submissions. The AI assistant can also be seamlessly integrated with enterprise systems using APIs, becoming an integral part of internal processes.

Conclusion

In conclusion, the integration of AI in banking and finance represents a transformative journey that promises improved efficiency, enhanced customer experiences, and streamlined workforce management. As the industry continues to evolve, the right balance between AI and human intervention becomes paramount. CloudApper AI stands as a reliable ally for organizations seeking to navigate this transformative journey, providing a user-friendly platform to build AI assistants that cater to the unique demands of the financial sector. By leveraging the power of AI, banking and finance institutions can stay ahead of industry trends, provide unparalleled customer service, and build a workforce ready to tackle the challenges and opportunities that lie ahead.

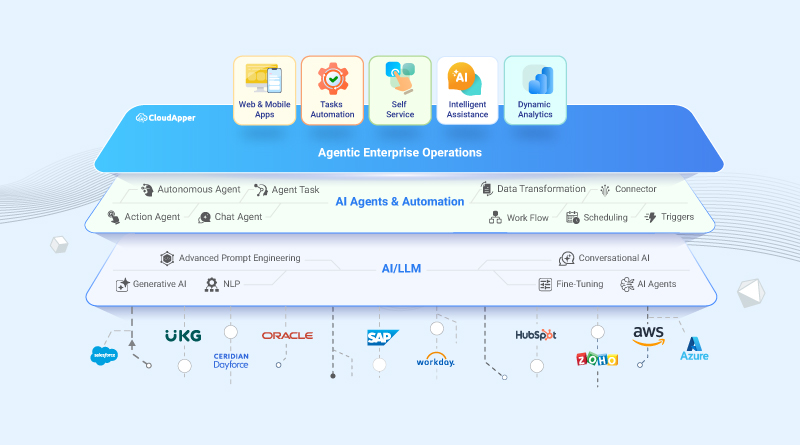

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

CloudApper AI Solutions

- Works with

- and more.

Similar Posts

What Experts Say About Enterprise Business Automation & Why You…

Enterprise Automation with AI: How to Streamline Your Business Operations