Discover how integrating AI/LLM technology into financial operations can enhance efficiency and drive success in the digital age with CloudApper AI's innovative solutions.

Table of Contents

Integrating cutting-edge technologies is essential for staying competitive and promoting growth in today’s fast-changing financial world. It includes powerful Artificial Intelligence (AI) and Large Language Models (LLM). In this article, we will discuss how incorporating AI/LLM technology into financial operations can make them more efficient and give financial companies the tools they need to succeed in the digital age.

Key Points

- Integrating AI/LLM technology in financial operations enhances efficiency and competitiveness.

- AI improves risk management by analyzing large datasets and predicting risks and opportunities.

- AI-powered chatbots and customer analytics optimize customer engagement with personalized advice and proactive support.

- AI-driven fraud detection systems identify and prevent financial fraud in real time, safeguarding assets and reputation.

Understanding the Use of AI in Finance

Integrating AI into finance transforms risk management, streamlines customer connections, and enhances fraud detection accuracy. With CloudApper’s enterprise AI solutions, banks can use predictive analytics, AI-powered chatbots, and fraud detection systems to help them make smart choices, connect with customers more personally, and avoid fraud. Using AI, companies can stay ahead of the curve, grow their businesses, and give their customers better experiences.

Key Applications of Enterprise AI in Financial Operations

Improvements to Risk Management

Enterprise AI systems change risk management by using advanced machine learning algorithms to look at huge datasets and find risks and possibilities. Using CloudApper AI’s custom AI solutions, financial institutions can proactively evaluate and reduce risks, improve portfolio management, and meet legal requirements. Companies can make smart choices and reduce their financial risks by using AI-driven predictive analytics in their risk assessment models.

Customer Engagement Optimization

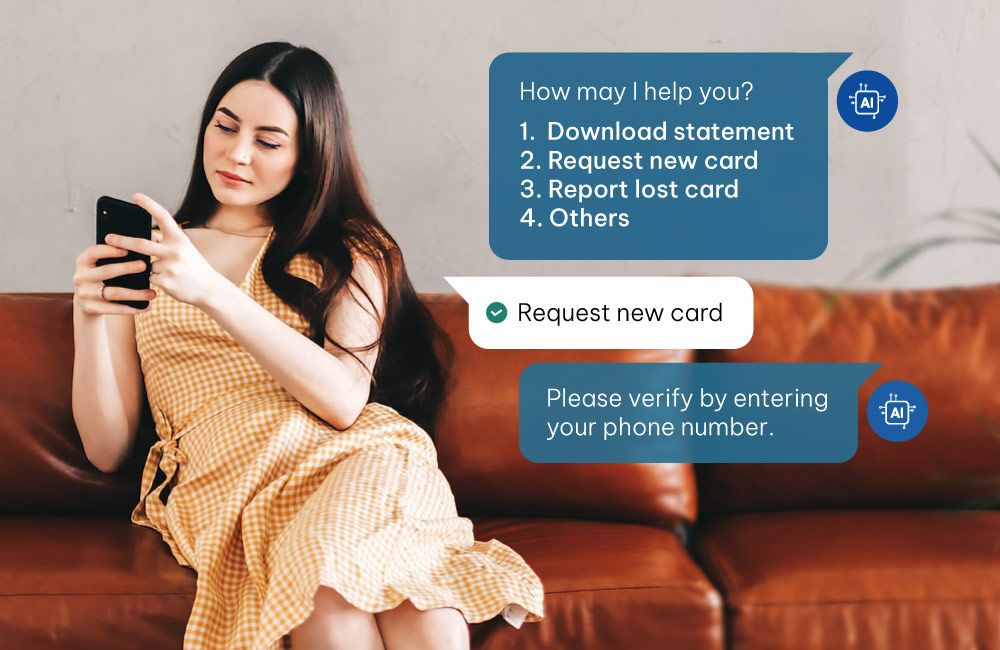

CloudApper AI’s business AI solutions are very important for increasing customer satisfaction and engagement in the finance industry. Financial institutions can give personalized advice, answer customer questions quickly, and offer proactive support by using chatbots and virtual assistants driven by AI. AI-powered customer analytics tools also help businesses learn a lot about their customers’ likes and dislikes and how they act, which lets them make more focused marketing campaigns and better products.

Fighting Financial Fraud

CloudApper’s enterprise AI solutions are essential for finding and stopping fraud in real time, which is important in the fight against financial fraud. AI-powered fraud detection systems can spot fishy activities and warn financial institutions about possible security threats by looking at transactional data and trends in user behavior. CloudApper AI’s advanced anomaly detection algorithms and predictive modeling techniques help businesses stay one step ahead of fraudsters and protect their assets and image.

Case Studies

Abraham Seyoum Transport and Spare Parts Import has embraced digital transformation with the adoption of SalesQ, empowered by CloudApper AI. By digitizing all sales and inventory-related tasks, the company has enhanced product management and customer tracking.

Conclusion

In conclusion, incorporating AI/LLM technology into financial operations allows businesses to improve processes, lower risks, and give customers a unique experience. With custom AI solutions that help banking institutions do well in today’s competitive market, CloudApper AI is at the forefront of this technological revolution. In the digital age, banking companies that want to stay ahead must adopt Enterprise AI. Contact CloudApper AI right away to learn how our cutting-edge AI solutions can change the way you handle your finances and help your business succeed.

FAQs

Q1: How does artificial intelligence improve risk management in financial operations?

AI employs powerful algorithms to examine massive datasets, identifying dangers and possibilities for improved decision-making.

Q2: Can AI/LLM technology improve consumer engagement?

Yes, AI-powered chatbots and virtual assistants offer tailored and efficient customer support.

Q3: How does artificial intelligence help in fraud detection?

AI algorithms scan transactional data to detect suspicious activity and notify financial institutions.

What is CloudApper AI Platform?

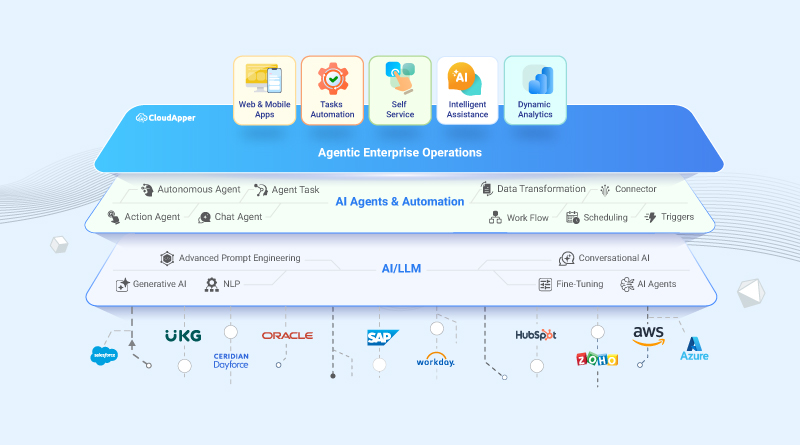

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

CloudApper AI Solutions

- Works with

- and more.

Similar Posts

What Experts Say About Enterprise Business Automation & Why You…

Enterprise Automation with AI: How to Streamline Your Business Operations