Learn how the OBBB Act’s new overtime rules and tax reporting changes impact employers—and how to automate compliance, prevent payroll errors, and simplify IRS reporting with accurate time tracking and AI-powered payroll integration.

Table of Contents

As labor laws and taxation policies continue to evolve, employers must stay informed about how changes impact overtime pay and payroll processing. The recent introduction of the One Big Beautiful Bill Act (OBBB Act) has introduced new salary thresholds and federal tax adjustments, reshaping how overtime compensation is calculated and taxed. This article outlines what employers need to understand, how to remain compliant, and how AI can simplify the process.

For more information on CloudApper hrPad visit our page here.

Understanding Overtime Pay Requirements

Under the Fair Labor Standards Act (FLSA), employees classified as non-exempt are entitled to overtime pay at a rate of 1.5 times their regular hourly rate for any hours worked beyond 40 in a workweek. Employers are responsible for correctly classifying employees, calculating overtime, and reporting earnings.

What Changed with the OBBB Act?

The One Big Beautiful Bill Act introduced two key changes to overtime policy in 2025:

- New Salary Thresholds

The minimum salary level for exempt employees has increased. As of July 1, 2025, employees earning below $48,500 annually must be classified as non-exempt, making them eligible for overtime. - Federal Tax Deductions and Reporting

Employers must now account for overtime differently in quarterly tax filings. New line items have been added to IRS Form 941 to separate base wages and overtime premiums. This increases reporting requirements and the need for more precise payroll records.

Tax Implications of Overtime Pay

Overtime compensation is subject to the same tax withholdings as regular wages, including:

- Federal income tax

- Social Security tax

- Medicare tax

- State and local taxes (where applicable)

However, the OBBB Act has increased the burden on employers to track and report these amounts separately. Errors in overtime classification or underreporting can result in penalties, back wages, and audits.

Compliance Challenges for Employers

For HR and payroll teams, the changes create new responsibilities:

- Monitoring salary levels to ensure accurate exemption classifications

- Tracking hours worked with greater accuracy

- Maintaining detailed records of overtime payments and tax breakdowns

- Ensuring timely filings under updated IRS guidelines

In industries with high overtime volumes—such as manufacturing, healthcare, retail, and logistics—manual systems can no longer support compliance reliably.

How CloudApper hrPad Simplifies Compliance

To reduce errors and support compliance with overtime pay rules, companies can adopt CloudApper hrPad, a fully customizable AI-powered employee self-service kiosk. Here’s how hrPad helps meet the new requirements:

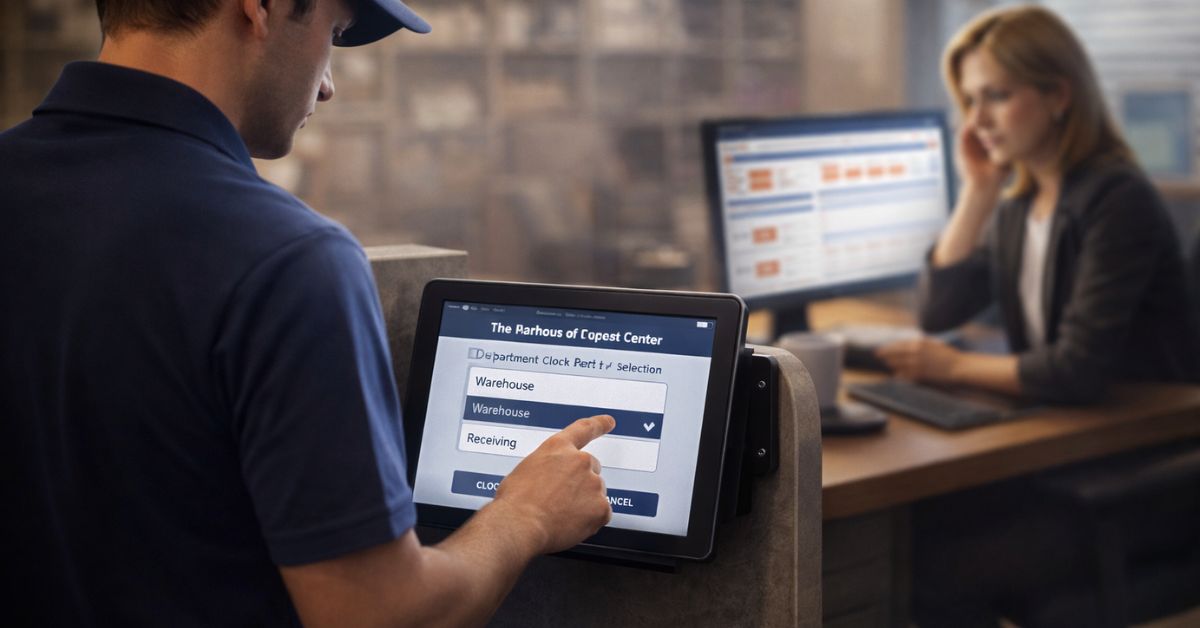

1. Accurate Time Tracking

hrPad ensures employees clock in and out accurately using Face ID verification or QR codes, eliminating buddy punching and time fraud. Geofencing capabilities allow automated location-based check-ins for distributed teams.

2. Automated Overtime Calculations

The system automatically calculates overtime based on company policies and FLSA guidelines, including the updated salary thresholds. This reduces reliance on spreadsheets or manual entries.

3. Real-Time Payroll Sync

hrPad integrates with major HCM and payroll systems like UKG, ADP, Paycom, and Workday. It ensures overtime hours and associated taxes are recorded correctly and transmitted in real-time to payroll processors, simplifying tax form preparation.

4. Custom Rule Configuration

Employers can configure hrPad to reflect company-specific pay rules, union agreements, or state-level laws. This ensures that overtime is calculated consistently and correctly for each employee group.

5. Compliance Reporting

hrPad can generate detailed reports that separate base pay from overtime earnings—essential for meeting the OBBB Act’s tax reporting updates. These records help reduce the risk of noncompliance and streamline audits.

Preparing for Audits and Enforcement

With the Department of Labor increasing audits and enforcement efforts, employers should:

- Review exemption classifications regularly

- Audit payroll reports to ensure overtime is calculated and taxed correctly

- Train HR teams on the latest requirements

- Use technology to document and track compliance activities

CloudApper hrPad makes it easy to maintain records and provide proof of compliance when requested.

Final Thoughts

The new federal updates to overtime pay and tax reporting demand greater accuracy and real-time tracking. Employers must adapt quickly to stay compliant and avoid penalties. By automating time capture, payroll sync, and reporting with CloudApper hrPad, organizations can reduce risk, save time, and ensure that their workforce is compensated fairly and in full compliance with the law. Contact us to learn more.

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

Brochure

CloudApper hrPad

Empower Frontline Employees with an AI-Powered Tablet/iPad Solution

Download Brochure

CloudApper AI Solutions for HR

- Works with

- and more.

Similar Posts

Driving Frontline Inclusion: Bilingual HR Policy Access with CloudApper hrPad

Solving the Deskless Divide: How Frontline-First HR Design Empowers the…