In the field of banking and finance, the demand for effective, tailored, and 24/7 customer service is increasingly urgent. Conventional approaches are facing difficulties in meeting the growing demand, resulting in delayed responses and customer discontentment. To tackle these challenges, banking professionals can leverage CloudApper’s Conversational AI, an AI-powered chatbot designed to transform the banking experience. By automating routine tasks, providing 24/7 customer support, and delivering personalized interactions, this AI-powered platform is set to redefine banking operations, promising efficiency, innovation, and an enhanced customer experience.

Benefits of Conversational AI in Banking Customer Support

Conversational AI in banking offers numerous benefits, including 24/7 availability, personalized interactions, and significant cost savings. CloudApper’s Conversational AI takes these advantages a step further by providing a seamless and efficient customer support experience. It can handle a wide range of inquiries, provide guidance, and offer solutions round the clock, ensuring consistent and prompt assistance whenever needed. This AI-powered assistant can automate routine tasks such as reporting lost cards, requesting new ones, or initiating the KYC process, thereby reducing manual intervention and allowing staff to focus on higher-value tasks. Furthermore, it can gather valuable customer insights to improve the banking experience continuously. With CloudApper’s Conversational AI, banks can elevate their customer support services, streamline operations, and enhance overall customer satisfaction.

5 Use Cases of CloudApper Conversational AI in Customer-Centric Banking

Automated Query Management: CloudApper’s Conversational AI can provide round-the-clock support to customers, handling inquiries, providing guidance, and offering solutions 24/7. For example, a customer can request a new card or report a lost card through the AI assistant, which will then guide them through the verification process.

Customer Onboarding: The AI platform can simplify and accelerate the customer onboarding process. For instance, when a customer expresses interest in opening a new bank account, the AI assistant can guide them through the process, offering options such as Savings Account, Checking Account, Certificates of Deposit, and Teen Savings Account.

Loan Application Assistance: CloudApper’s Conversational AI can assist customers in applying for loans by providing information about interest rates. For example, when a customer wants to apply for a loan, the AI chatbot can ask about the type of loan they’re interested in, such as Personal Loan, Home Loan, Auto Loan, or Student Loan, and provide relevant information.

Locate Nearest ATM/Branch: Conversational AI can integrate with a customer’s device geolocation to detect their location. It can provide the customer with information about the closest ATM or bank branch facilities. Its voice recognition technology can guide customers to reach their closest ATM or branch. It provides crucial details such as the distance of the closest ATM, timings of the facility, operational hours, and directions.

Provide Feedback: Customers can share their experiences, preferences, and demands during or after their interactions with the AI, which is then systematically collected and analyzed to bring updates and changes to the existing system, ultimately enhancing overall customer satisfaction.

Conclusion

The integration of Conversational AI in the banking sector is not just a technological advancement, but a strategic move towards enhancing customer experience and operational efficiency. It offers a seamless, personalized, and secure banking experience, meeting the evolving demands of the digital-savvy generation. It’s clear that the future of banking lies in the successful implementation of Conversational AI, transforming the way banks engage with their customers. If you’re a financial institution looking to elevate your customer support and streamline your operations, it’s time to embrace Conversational AI. Request a free demo and take the first step towards revolutionizing your banking services with CloudApper.

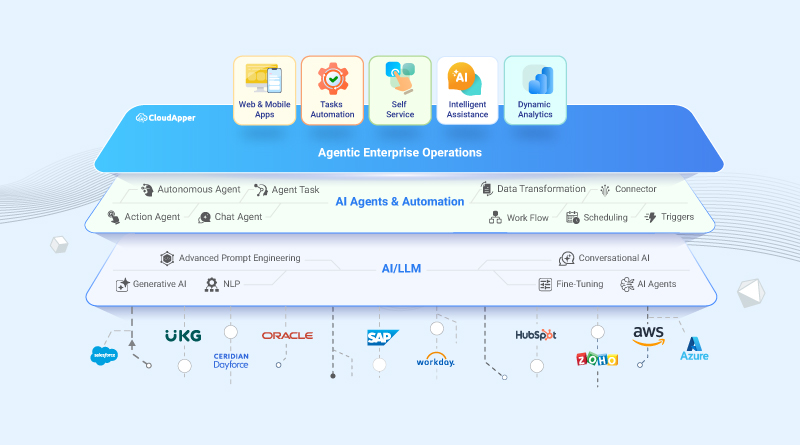

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More