In the intricate world of banking and finance, operational efficiency is paramount. Banks are constantly seeking ways to streamline their routine operations to enhance productivity and customer satisfaction. However, the challenge lies in managing repetitive tasks, which can be time-consuming and prone to human error. This is where CloudApper’s Conversational AI comes into play. Our AI-powered solution automates routine tasks, reduces manual intervention, and optimizes workflow, thereby significantly improving operational efficiency. By integrating CloudApper’s Conversational AI, banks can not only enhance their operational efficiency but also provide a seamless and personalized banking experience to their customers.

How Conversational AI Streamlines Banking Operations?

CloudApper’s Conversational AI plays a pivotal role in streamlining routine operations in the banking sector. It automates repetitive tasks, thereby improving overall operational efficiency. For instance, it can handle inquiries, provide guidance, and offer solutions round-the-clock, reducing the need for manual intervention. It also simplifies and accelerates the customer onboarding process by gathering necessary information swiftly through conversations. Furthermore, it assists in the KYC process by collecting required details such as contact numbers and social security numbers. By automating these routine tasks, CloudApper’s Conversational AI allows banking staff to focus on higher-value tasks, ultimately leading to a 20% increase in operational efficiency.

Top 6 Use Cases of CloudApper’s Conversational AI to Streamline Banking Operations

Customer Support: The AI can handle inquiries, provide guidance, and offer solutions 24/7. This ensures consistent and prompt assistance whenever needed. For example, if a customer wants to request a new card, the AI can guide them through the process.

Customer Onboarding: The AI can simplify and accelerate the customer onboarding process. For instance, if a customer wants to open a new bank account, the AI can gather necessary information swiftly through conversations and guide them through the process of choosing the right type of account.

Document Review: CloudApper AI can review and summarize large volumes of banking documents, such as agreements, pledges, and statements. This helps banking professionals quickly identify key information and make informed decisions.

Operational Efficiency: The AI can automate routine tasks and processes, reducing manual intervention and enabling staff to focus on higher-value tasks. For example, if a customer wants to apply for a loan, the AI can ask them about the type of loan they’re interested in and provide them with the relevant information.

Issue Resolution: The AI can swiftly resolve issues. For instance, if a customer has lost their credit card and wants to request a new one, the AI can guide them through the process of reporting the lost card and requesting a new one.

KYC Process: The AI can streamline the KYC process by asking the customer to provide their registered contact number and Social Security Number.

Conclusion

The integration of CloudApper’s Conversational AI in banking and finance operations has revolutionized the industry by automating routine tasks, enhancing operational efficiency, and providing round-the-clock support. This AI-powered technology not only streamlines workflows but also fosters meaningful connections with customers, offering them a seamless and personalized banking experience. As we move forward in this digital age, it’s crucial for financial institutions to leverage such innovative solutions to stay competitive and meet the evolving needs of their customers. Don’t let your banking operations lag behind in this digital revolution. Experience the power of CloudApper’s Conversational AI today and unlock a new level of banking excellence.

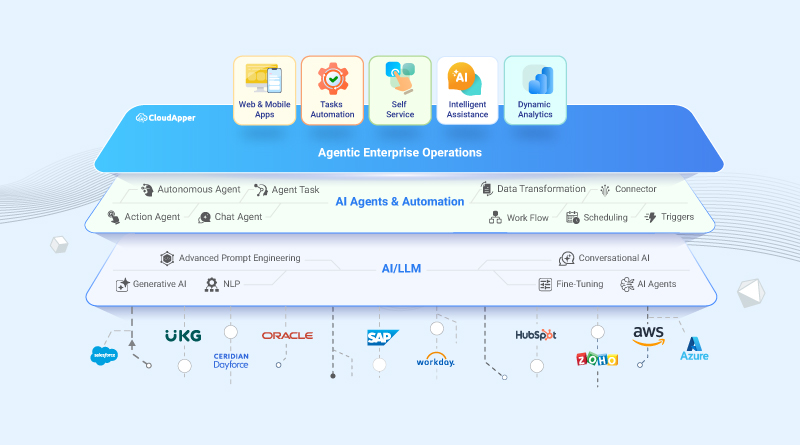

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More