Noncompliance with timekeeping laws can cost millions in fines and lawsuits. CloudApper AI TimeClock simplifies tracking, automates compliance, and integrates seamlessly with HR systems like UKG, ADP, and Workday. Ensure accurate records, enforce break policies, and protect your business with a modern, customizable time clock solution.

Table of Contents

According to the U.S. Department of Labor, companies pay more than $3 billion annually to resolve wage and hour violations. Even large organizations using advanced HR systems like UKG, ADP, Workday, Oracle HCM, PeopleSoft, isolved, and SAP SuccessFactors are not immune to compliance pitfalls. If you’re a workforce management professional, you know how quickly an inaccurate timekeeping process can spiral into lawsuits, regulatory investigations, and damaged trust with your employees.

For more information on CloudApper AI TimeClock visit our page here.

In my 20+ years managing time and labor processes for mid-market and enterprise employers, I’ve seen firsthand how robust time clock compliance practices can dramatically reduce risk. This article will help you understand exactly what labor laws require, why time tracking is critical, and how modern solutions like CloudApper AI TimeClock can protect your organization.

What Are the FLSA Timekeeping Requirements You Must Follow?

The Fair Labor Standards Act (FLSA) is the federal baseline for time tracking. Whether you use paper timesheets or a modern HCM suite, you must ensure:

| FLSA Requirement | What It Means |

| Accurate Hours Worked | Track all hours employees actually work (including pre-shift and post-shift activities). |

| Overtime Pay | Pay time and a half for hours over 40 in a workweek. |

| Record Retention | Keep payroll records, including timecards, for at least 3 years. |

| Meal and Rest Breaks | Depending on state law, provide paid or unpaid breaks and track them accordingly. |

Best Practice Tip:

In my experience, confusion often arises around “off the clock” work. For example, if an employee checks email before punching in, those minutes are compensable. This is why precise, automated time capture is essential.

Why Are State Break Laws So Critical?

Many workforce management professionals assume federal law is enough. However, states like California, New York, and Oregon impose stricter requirements. For instance:

- California: Non-exempt employees must receive a 30-minute unpaid meal break if working more than 5 hours, and two rest breaks for shifts over 6 hours.

- New York: Requires meal periods depending on the time and duration of work.

- Oregon: Mandates paid rest breaks every 4 hours.

Failing to comply can result in penalties ranging from $50 per violation to class action lawsuits costing millions.

Example from Practice:

A retail client in California using a legacy time system was fined over $500,000 in back pay and penalties because rest breaks weren’t properly documented. After deploying automated prompts through CloudApper AI TimeClock, they reduced compliance incidents to zero within 6 months.

How Can Inaccurate Time Tracking Lead to Lawsuits?

Here are the most common scenarios that spark legal trouble:

- Rounding Errors:

Many organizations round time entries to the nearest 15 minutes. This is only legal if it doesn’t systematically disadvantage employees.

- Missed Meal and Rest Breaks:

Even if you offer breaks, failing to document them can look like noncompliance.

- Overtime Misclassification:

Employees incorrectly categorized as exempt can trigger FLSA claims.

- Off-the-Clock Work:

Work performed before clock-in or after clock-out must be tracked and paid.

According to the Wage and Hour Division, over 70% of employers audited were not in full compliance.

What Is the Role of Automated Time Clocks in Ensuring Compliance?

Automated time clocks are not simply convenience tools—they’re compliance shields. Solutions like CloudApper AI TimeClock provide:

- Real-Time Punch Capture: Ensures no time worked goes unrecorded.

- Meal and Break Attestation: Employees confirm whether they took breaks.

- Custom Rules Enforcement: Automatically apply different policies across states.

- Audit Trails: Immutable records for regulators and legal defense.

Why This Matters:

When I consulted for a logistics company using manual timesheets, they had to produce years of records during a Department of Labor investigation. It took them months. If they’d used an automated system with digital audit trails, the process would have taken a day.

What Are the Best Practices for Time Clock Compliance?

- Standardize Policies Across Locations

While rules vary by state, your system should standardize the collection process while accommodating local requirements. - Use Break Attestations

Prompt employees to attest whether they received all breaks. This record is invaluable if claims arise. - Automate Overtime Calculations

Manually calculating overtime is error-prone. Use time clocks that automatically calculate premiums. - Integrate With Payroll Systems

Disconnects between time tracking and payroll are a major compliance hazard. Choose solutions with seamless integration into UKG, ADP, SAP, Workday, and other platforms. - Conduct Regular Audits

Quarterly audits can uncover systemic errors before they become legal liabilities.

How Does CloudApper AI TimeClock Solve Compliance Challenges?

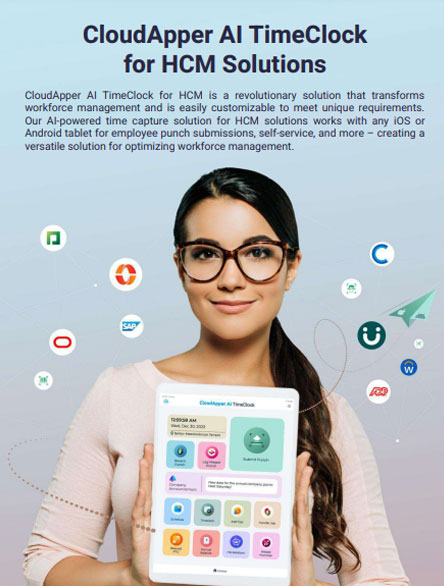

CloudApper AI TimeClock is an intelligent, cloud-based time tracking solution designed to simplify compliance and enhance productivity.

Key Features and Benefits:

| Feature | Benefit |

| Customizable Compliance Rules | Automatically enforce FLSA and state requirements. |

| Mobile & Kiosk Punching | Allow employees to clock in anywhere, reducing bottlenecks. |

| Real-Time Attestations | Capture confirmations for breaks, shifts, and overtime. |

| Seamless HR/HCM/Payroll Integration | Connects with UKG, ADP, Workday, SAP, isolved, and more. |

| Geofencing and Facial Recognition | Prevent buddy punching and ensure location compliance. |

| Automated Notifications | Remind employees about breaks and punch times. |

| Custom Workflow Automation | Build compliance workflows without needing IT. |

From My Experience:

One of my clients, a manufacturing firm with 1,200 employees, replaced an outdated badge reader system with CloudApper AI TimeClock. Within 90 days, compliance-related payroll adjustments dropped by 82%.

How to Implement CloudApper AI TimeClock

Step 1:

Define your compliance policies (federal, state, and internal).

Step 2:

Set up CloudApper AI TimeClock to reflect these rules using the no-code configuration.

Step 3:

Train managers and employees on using kiosks and mobile apps.

Step 4:

Integrate with your HR or payroll system for seamless data flow.

Step 5:

Review reports and conduct periodic audits to ensure continued compliance.

FAQs About Time Clock Compliance

Q: Is rounding employee time entries legal?

A: Yes, but only if it doesn’t consistently underpay employees. The safest route is to capture time to the exact minute.

Q: What happens if an employee forgets to clock in or out?

A: You must still pay for all hours worked. CloudApper AI TimeClock can alert supervisors immediately when punches are missed.

Q: Do I need to track remote employees’ time?

A: Absolutely. FLSA and state laws still apply. CloudApper enables remote time tracking with geofencing.

Q: How long should I retain time records?

A: Under FLSA, you must keep them for at least 3 years. State laws may require longer.

How CloudApper AI TimeClock Enhances Workforce Management Beyond Compliance

While compliance is the foundation, CloudApper AI TimeClock offers additional benefits:

- Employee Self-Service: Let staff review hours, request time off, and confirm records.

- Flexible Deployment: Use any tablet, phone, or kiosk—no expensive hardware.

- Advanced Analytics: Identify trends in absenteeism and overtime.

- Custom Alerts: Notify HR or managers when compliance thresholds are nearing.

- Scalable Workflows: Easily adjust policies as regulations change.

Conclusion

Compliance with FLSA and state labor laws isn’t optional—it’s a strategic priority. The cost of noncompliance goes far beyond fines; it damages reputation and employee trust. As someone who’s navigated these challenges across industries, I can attest that modern, automated solutions like CloudApper AI TimeClock are no longer nice-to-have—they’re essential.

If you’re ready to reduce risk and streamline your entire time and attendance process, CloudApper AI TimeClock provides the adaptability, integration, and intelligence you need to stay ahead.

Ready to see how CloudApper AI TimeClock can protect your business and simplify workforce management?

Learn more and request a demo today.

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

Brochure

CloudApper AI TimeClock

For accurate & touchless time capture experience.

Download Brochure

CloudApper AI Solutions for HR

- Works with

- and more.

Similar Posts

The “Zero-Touch” Shield: How AI Time Tracking Can Protect the…

UKG Pro WFM (Dimensions) Time Clock With Face ID for…