Explore how Automated Payroll Integration can eliminate the risks of manual payroll exports, enhancing accuracy, security, and efficiency. Discover the benefits of CloudApper iPaaS in transforming payroll operations and ensuring compliance in today's digital landscape.

Table of Contents

Have you ever wondered how a single misplaced digit in a spreadsheet could cascade into payroll chaos, eroding employee trust and inflating operational costs? In the fast-evolving landscape of finance and HR management, manual processes are increasingly becoming relics of the past, stifling efficiency and exposing businesses to unnecessary risks. As organizations grapple with the demands of seamless data handling and regulatory compliance, embracing Automated Payroll Integration emerges as a game-changer. This thought leadership piece delves into the perils of outdated manual exports and champions innovative solutions like CloudApper iPaaS to revolutionize payroll operations.

What Are the Biggest Risks of Relying on Manual CSV Exports for Payroll?

In the realm of payroll processing, manual CSV exports have long been a staple for finance teams juggling systems like UKG, Workday or Dayforce. However, this approach is fraught with hidden dangers that can undermine the very foundation of your business operations. Drawing from years of observing industry trends, it’s clear that these manual methods amplify vulnerabilities in an era where data precision is non-negotiable. Let’s explore these risks in depth, supported by practical insights and examples that highlight the urgent need for Automated Payroll Integration.

One of the most prevalent issues is human error, which can turn a routine task into a costly debacle. Consider a scenario where a finance specialist, under the pressure of tight deadlines, inadvertently swaps columns in a CSV file while transferring time-tracking data from UKG to Workday. This simple mistake could lead to widespread inaccuracies in pay calculations, affecting employee morale and requiring extensive rework. Industry reports consistently show that such errors contribute to significant financial losses, with corrections often consuming hours that could be better spent on strategic initiatives. Automated Payroll Integration addresses this by eliminating the human element in data transfers, ensuring accuracy from the outset.

Security breaches represent another critical threat. When sensitive payroll information is shuttled via unsecured CSV files—perhaps attached to an email or stored on a shared drive—the risk of data leaks skyrockets. Imagine a cyber intruder intercepting an export containing employee Social Security numbers and salary details; the fallout could include legal repercussions and reputational damage. In today’s digital age, where data privacy regulations are stringent, manual processes fall short of providing the robust safeguards needed. Solutions like CloudApper iPaaS, with its role-based access controls and encrypted data flows, offer a fortified alternative, making Automated Payroll Integration not just efficient but essential for security-conscious organizations.

Moreover, delays in payroll processing due to manual verification can lead to late paychecks, fostering employee dissatisfaction and potentially increasing turnover rates. For growing enterprises using Paychex, these bottlenecks can transform what should be a streamlined cycle into a protracted ordeal. From my perspective as an expert in payroll automation, these delays are symptomatic of broader inefficiencies that hinder scalability. By transitioning to Automated Payroll Integration, businesses can achieve real-time synchronization, ensuring timely disbursements and maintaining a motivated workforce.

How Does Automated Payroll Integration Solve Common Payroll Challenges?

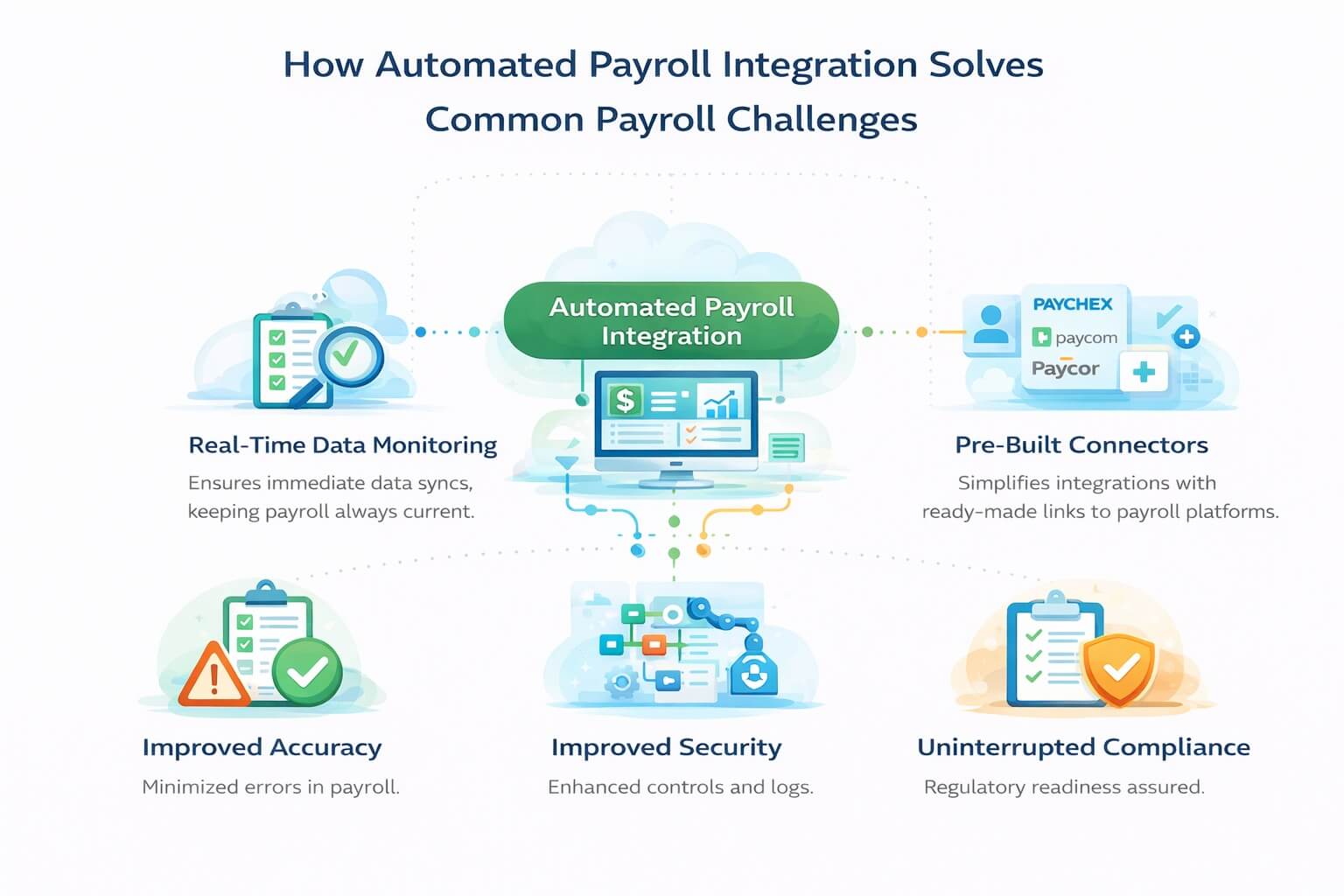

Automated Payroll Integration isn’t merely a technological upgrade; it’s a strategic imperative for finance teams seeking to overcome the limitations of manual processes. At its core, this integration streamlines data flows between disparate systems, fostering efficiency and compliance in ways that manual exports simply cannot match. CloudApper iPaaS exemplifies this by serving as a no-code, fully managed platform that connects HR, payroll, and finance applications seamlessly.

One standout feature is real-time data monitoring, which keeps payroll information perpetually current. Unlike manual exports that require periodic updates and are prone to oversights, CloudApper iPaaS detects changes instantly, triggering automated syncs that maintain data integrity. This capability is particularly valuable for organizations dealing with dynamic workforces, where shifts in hours or attendance must be reflected promptly in payroll systems like UKG or Workday.

Pre-built connectors further simplify the integration process. Finance professionals no longer need to wrestle with custom coding or IT dependencies; instead, they can leverage ready-made connectors to Paychex, Paycom, Paycor and other platforms. This no-code interface empowers non-technical users to configure workflows intuitively, shifting focus from tedious data handling to high-level strategy. In my experience, this democratizes automation, allowing teams to innovate without barriers.

Automated workflows are another pillar of this solution, eradicating the drudgery of manual tasks. By automating data syncs, CloudApper iPaaS reduces errors and accelerates processing times, directly tackling pain points like late paychecks. Audit logging ensures every transaction is recorded, providing an audit-ready trail that simplifies compliance efforts. Coupled with role-based access controls, this enhances security, preventing unauthorized access and mitigating risks of data leaks.

From a thought leadership standpoint, the shift to Automated Payroll Integration reflects a broader industry trend toward digital transformation. Businesses that adopt platforms like CloudApper iPaaS position themselves as forward-thinking leaders, capable of adapting to evolving challenges such as regulatory changes and workforce mobility. Examples abound of companies that have slashed processing times by half, thanks to these integrations, illustrating the tangible ROI.

What Benefits Can Businesses Expect from CloudApper iPaaS in Automated Payroll Integration?

Switching to CloudApper iPaaS for Automated Payroll Integration yields a multitude of benefits that extend beyond immediate fixes, building a resilient foundation for long-term success. Improved data accuracy tops the list, as automation eradicates the human errors inherent in manual CSV exports. This precision translates to fewer discrepancies in pay calculations, fostering trust among employees and reducing the administrative burden on finance teams.

Faster deployments are a key advantage, with pre-built connectors enabling integrations in days rather than months. This agility is crucial for scaling operations without disrupting existing systems. Scalability itself is enhanced, as CloudApper iPaaS grows alongside your organization, accommodating increased data volumes and complexity without the need for overhauls.

Efficiency gains are profound, with streamlined workflows cutting down on manual interventions and freeing up resources for value-added activities. Enhanced security measures protect against leaks, ensuring sensitive information remains safeguarded during transfers. Reliability is assured through consistent data flows, while audit-ready compliance features make regulatory adherence effortless.

Consider a mid-sized enterprise that integrated Workday or UKG with its payroll system via CloudApper iPaaS. Previously plagued by manual export errors, the firm now enjoys seamless synchronization, catching discrepancies in real-time and averting potential compliance issues. Such examples underscore how Automated Payroll Integration with CloudApper iPaaS solves core pain points, delivering efficiency, security, and reliability that manual methods cannot rival.

Is Automated Payroll Integration the Future of Finance Operations?

As we navigate the complexities of modern finance, it’s evident that Automated Payroll Integration represents the future, addressing industry challenges like data silos and compliance pressures head-on. Manual exports, while once viable, now pose liabilities in a landscape demanding speed and precision. Platforms like CloudApper iPaaS lead the charge by offering no-code solutions that empower teams to innovate and thrive.

In reflecting on industry trends, the move toward automation aligns with a push for digital resilience. Organizations that lag behind risk operational stagnation, while those embracing tools like CloudApper iPaaS gain a competitive edge. The value lies not just in technology but in the strategic insights it unlocks, enabling finance leaders to focus on growth rather than grunt work.

Ultimately, the case for Automated Payroll Integration is compelling, with CloudApper iPaaS standing out for its comprehensive features and proven benefits. By integrating systems like UKG, Workday, Paychex, Paycom, Paycor and Dayforce, it transforms payroll from a chore into a strategic asset.

Ready to revolutionize your payroll processes and leave manual exports behind? Discover how CloudApper iPaaS can deliver seamless Automated Payroll Integration for your team. Visit our website today to schedule a demo and take the first step toward efficiency, security, and compliance excellence.

Frequently Asked Questions

- What are the risks associated with manual CSV exports in payroll processing?

- Manual CSV exports can introduce serious vulnerabilities such as human errors leading to inaccuracies, data leaks compromising security, and late paychecks causing employee dissatisfaction.

- How does CloudApper iPaaS ensure data accuracy in payroll?

- CloudApper iPaaS automates data synchronization across platforms with real-time monitoring, eliminating manual errors and ensuring accurate payroll calculations.

- What systems can CloudApper iPaaS integrate with?

- CloudApper iPaaS can integrate with popular systems like ADP, Paychex, and Cerner, using pre-built connectors for seamless setup and operation.

- How does CloudApper iPaaS enhance data security during payroll processing?

- It secures data through role-based access controls and robust security measures, protecting sensitive information during transfers and ensuring compliance with regulations.

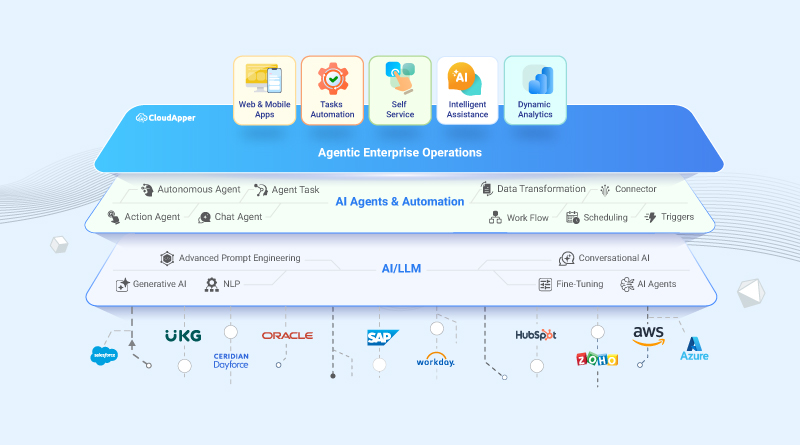

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

CloudApper AI Solutions

- Works with

- and more.

Similar Posts

Employee Lifecycle Management with Identity and Access Management (IAM) Integration

REST API Integration for Legacy Systems: How CloudApper iPaaS Bridges…