The world of finance moves at a breakneck pace, so precision and efficiency are key. There are a lot of mundane, time-consuming chores that banks and other financial institutions have to deal with daily. Maintaining high-quality service and happy customers while handling these repetitive tasks is challenging. Now, there is a game-changing solution that can automate these mundane tasks: CloudApper’s Conversational AI for Banking. This tool automates routine tasks in banking by harnessing the power of artificial intelligence. Simply put, CloudApper’s Conversational AI will revolutionize the banking industry by making it more customer-centric and efficient.

AI’s Meteoric Rise in Finance & Banking

The adoption of Artificial Intelligence (AI) in the finance and banking sector has seen a meteoric rise in recent years. The need for enhanced operational efficiency, cost reduction, and improved customer experience primarily drives this surge. AI has revolutionized how financial institutions operate, automating routine tasks in banking, streamlining operations, and providing valuable insights for informed decision-making. It has also transformed customer interactions, offering personalized, round-the-clock support through AI-powered Conversational AI. However, implementing AI in finance and banking has challenges, including data security, privacy concerns, and the need for continuous improvement and adaptation to changing customer needs and preferences. CloudApper’s Conversational AI for healthcare addresses these challenges and offers a robust and secure solution. It provides 24/7 personalized support, automates routine tasks, and collects valuable customer feedback for continuous improvement, ensuring a seamless and secure banking experience for all users.

How Conversational AI Automates Routine Tasks in Banking?

Conversational AI is programmed to understand and respond to various customer queries. These AI systems are designed to understand natural language to interpret the customer’s request accurately.

In the context of customer service, conversational AI can be used to provide customers with information about a variety of topics, such as:

Operating hours: Conversational AI can provide customers with information about the company’s operating hours, including the hours of operation for different departments and the availability of customer service representatives.

Necessary forms: Conversational AI can provide customers with links to or instructions for downloading necessary forms, such as account opening forms or loan applications.

Procedures: Conversational AI can provide customers with step-by-step instructions for completing tasks, such as setting up a new online account or resetting a password.

Regulations: Conversational AI can provide customers with information about the company’s policies and procedures and applicable laws and regulations.

Interest rates: Conversational AI can inform customers about the company’s current interest rates for different accounts, such as savings accounts and loans.

Benefits of different types of accounts: Conversational AI can provide customers with information about the benefits of different types of accounts, such as the features and fees associated with each type of account.

Minimum deposit rate: Conversational AI can inform customers about the minimum deposit rate for different accounts.

Loan Status: In the case of a loan application status, the AI can check the current status of the application in the bank’s system and inform the customer if it’s been approved, is still under review, or if additional information is needed.

Location Status: Conversational AI can inform customers about the closest ATM or bank branch facilities. It provides crucial details such as the distance of the closest ATM, facility timings, operational hours, and directions.

Provide Feedback: Customers can share their experiences, preferences, and demands during or after their interactions with the AI, which is then systematically collected and analyzed to bring updates and changes to the existing system, ultimately enhancing overall customer satisfaction.

The Benefits

Conversational AI can provide these services 24/7, ensuring that customers can get the information they need at any time without waiting for a human representative to be available.

In addition to the benefits mentioned above, conversational AI can help reduce costs and improve efficiency. Conversational AI can handle a large volume of customer inquiries without human intervention, which can free up customer service representatives to handle more complex issues. Conversational AI can also automate tasks like providing customer updates and answering frequently asked questions.

Conclusion

Overall, conversational AI is a powerful tool that can be used to automate routine tasks in banking and improve efficiency. We expect to see even more innovative applications as conversational AI technology develops. If you’re a financial institution looking to elevate customer support and streamline operations, it’s time to embrace Conversational AI. Request a free demo and take the first step towards revolutionizing your banking services with CloudApper.

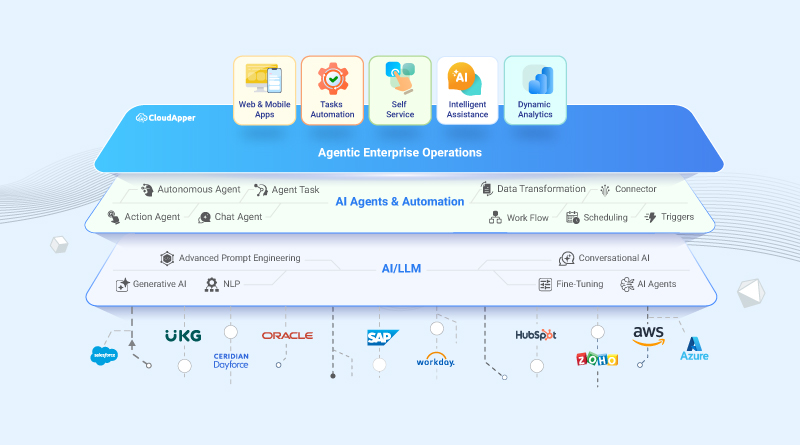

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More