Customer expectations for streamlined and tailored experiences are through the roof in the banking and financial industry. Customer dissatisfaction and operational inefficiencies result when traditional banking methods fail to meet these demands. A game-changing solution that will revolutionize banking is CloudApper’s Conversational AI for Banking. By harnessing the potential of AI, this platform enhances the banking customer experience to new heights by providing personalized support around the clock, automating mundane tasks, and streamlining operations.

AI for Banking Customer Experience

Artificial Intelligence (AI) has revolutionized the banking sector, offering two primary options for enhancing customer experience: chatbots and conversational AI. Both technologies aim to streamline customer interactions, automate routine tasks, and provide personalized service. However, they differ in their capabilities and the level of sophistication they bring to customer interactions.

Traditional Chatbots vs Conversational AI

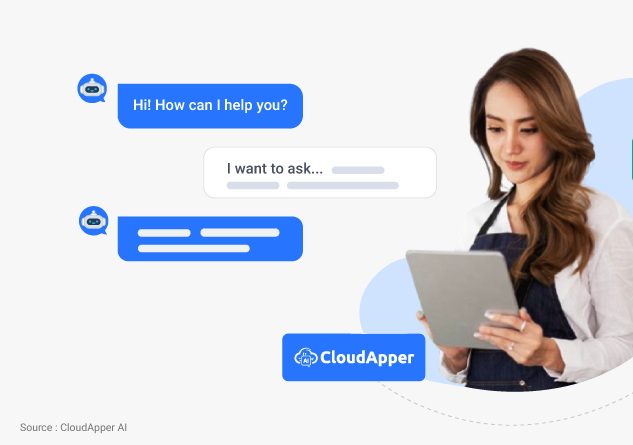

Chatbots are tools that can interact with customers in real time, answering queries and providing information. However, their responses are often pre-programmed and may require more in-depth context understanding for more complex customer interactions.

Conversational AI, on the other hand, offers a more advanced solution. To comprehend and react to consumer inquiries in a more personable way, it employs machine learning and Natural Language Processing (NLP). Conversational AI can handle more complex tasks, such as collecting customer feedback, applying for credit card limit increases, and even assisting in the KYC process. It can interact with customers in various ways, allowing for the development of unique brand experiences that boost acquisition, conversion, retention, and loyalty.

CloudApper’s Conversational AI is a compelling solution for enhancing the banking customer experience. It delivers human-like interactions, streamlines routine operations, and swiftly resolves issues. With 24/7 availability, significant cost savings, and personalized interactions, CloudApper’s AI chatbots elevate the customer experience while automating repetitive tasks. By leveraging valuable data insights for informed decision-making, CloudApper’s conversational AI can genuinely transform the banking customer experience.

How Conversational AI Improves Banking Customer Experience

24/7 Service

One of the key ways conversational AI improves customer experience in banking is through its 24/7 availability. Traditional banking services are limited by working hours and can be inaccessible during holidays or after-hours. However, conversational AI, such as CloudApper, is available round the clock. They provide instant answers to customer queries and guide people through automated workflows that allow them to complete their banking tasks in less time. This constant availability reduces frustration and helps cut wait times, enhancing customer experience.

Personalized Support

CloudApper’s Conversational AI also offers personalized support to banking customers. It treats customers as individuals with unique needs and preferences rather than just another account number. By analyzing customers’ wants, CloudApper AI can recommend suitable banking products. This level of personalization makes customers feel valued and understood, leading to higher customer satisfaction.

Streamlining Customer Interactions

Conversational AI can streamline customer interactions by automating routine replies to customer queries. This reduces the workload of customer service representatives and ensures that customers receive quick and consistent responses. Whether requesting a new checkbook, asking for account opening forms, or general FAQs, conversational AI can handle these tasks efficiently, freeing human agents to handle more complex issues.

Minimizing Errors in Customer Service

Another advantage of CloudApper’s Conversational AI in banking is its ability to minimize errors in customer service. Unlike humans, artificial intelligence (AI) remains alert and error-free throughout the day. It can accurately provide information and perform tasks, ensuring high accuracy in customer service. This reliability can significantly enhance the customer’s trust in the bank’s services.

Improving Efficiency in Onboarding

Conversational AI can significantly enhance the efficiency of the onboarding process for new customers in banks. It can assist customers in filling out forms and provide information on procedural requirements, thereby streamlining the account opening process. It can also provide necessary information about banking products and services to the customers at the right time or even assist in the KYC process.

The Bottom Line

In conclusion, conversational AI is crucial in improving customer experience in the banking sector. Its ability to provide 24/7 service, personalized support, streamlined interactions, error-free customer service, and its efficiency in onboarding and training makes it an invaluable tool in modern banking. As AI technology continues to evolve, its impact on customer experience in banking is expected to grow even further.

Take advantage of the opportunity to incorporate conversational AI into your banking service or institution. Request a demo of CloudApper’s Conversational AI today.

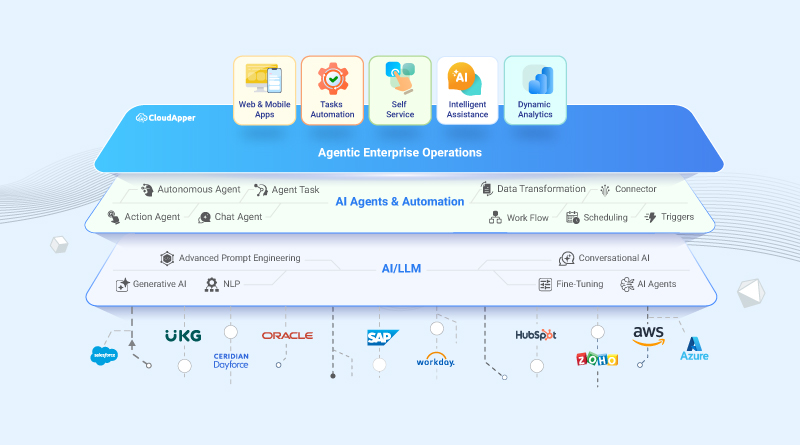

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More