Table of Contents

The U.S. Department of Labor (DOL) administers and enforces more than 180 rules in the wide terrain of U.S. labor laws. Wages, hours, overtime, and parental leave are only a few of the many topics covered by these statutes. When dealing with a unionized workforce, it is especially important for employers to have a working knowledge of the rules pertaining to time monitoring.

For more information on CloudApper AI TimeClock visit our page here.

In this piece, we’ll discuss why it’s crucial to retain detailed time records for employees, and how a good clock in clock out system like CloudApper AI TimeClock can guarantee equitable compensation, conform to unionized workforce requirements, and streamline compliance.

The Role of Accurate Time Tracking in Compliance

Accurate and complete records of employee time in the workplace are foundational to meeting requirements of federal and state labor regulations in the United States. The Fair Labor Standards Act (FLSA), a major piece of law that regulates many elements of work, including time monitoring, is the legal basis for this practice.

Some important things to remember about timesheets and regulations are as follows:

FLSA: A Pillar of Compliance

Employers must be familiar with FLSA in order to comply with federal regulations governing labor and employment. This is of fundamental importance for laws that mandate the keeping of records and the monitoring of employee time.

Employer Liability

In the event of inaccuracies or anomalies in the monitoring of employees’ work hours, employers may be held accountable for damages.

Method of Time Tracking

However, while rules require companies to keep account of employees’ hours worked, they do not specify how this should be done. The reliability and consistency of the information is of paramount importance.

Importance of Effective Time Tracking

Keeping tabs on employee hours worked, managing payroll more efficiently, and complying with regulations may all be accomplished with the use of time monitoring software or mobile time tracking applications.

CloudApper AI Time Clock

Thunder Gaming Choose CloudApper AI TimeClock With Face Recognition For Employee Time Tracking

Understanding Time Tracking Laws in the US

When it comes to keeping track of employees’ time on the job, the Fair Labor Standards Act (FLSA) is one of the most important federal statutes.

Key Provisions of FLSA

Minimum Wage

The Fair Labor Standards Act (FLSA) requires that workers be paid at least $7.25 per hour. The federal minimum wage and state minimum wage may differ, but businesses that are required to comply with both must pay the greater of the two. Each breach of this clause may result in a $1,000 civil court fine.

Overtime Pay

Employees who are not excluded from the Fair Labor Standards Act are entitled to overtime compensation if they work more than 40 hours in a workweek. Overtime compensation must be at least 1.5 times the regular hourly rate, but no less than 2 times the rate. Weekend and holiday labor is not automatically considered overtime, because the law only mandates payment for actual extra work.

Work Hours

The time an employee is expected to be at work, whether physically present or on duty, is considered part of their “work hours.” Employers must keep accurate records of employee hours worked for a minimum of three years and give employees with clear communication regarding FLSA duties.

Distinguishing Non-Exempt and Exempt Employees

Employees who are not excluded from the Fair Labor Standards Act are entitled to the minimum wage and overtime compensation required by the law. In contrast, exempt employees are those who are paid a wage but whose duties do not fall within the definition of “ordinary” work. Exempt workers are not subject to the same requirements under the FLSA as non-exempt workers.

Employer Timekeeping Obligations: A Primer

Accurate timekeeping is essential for legal compliance and is the duty of the employer. They can remind workers to keep track of their time, but mistakes in the system might get them in trouble with the law on either the federal or state level.

Methods for Tracking Work Hours

Timekeeping may be done in a number of ways, from paper timesheets and electronic time tracking applications to the more conventional time cards and swipe cards. The regulations do not mandate a particular method of tracking, but they do stress the need for reliable and consistent data collecting and calculation.

How to Round Up Work Hours:

To avoid fines, it is crucial to accurately round up labor hours. The “7-minute rule” is a tried and true strategy that companies may use:

- If an employee clocks in at 09:07, the work time is rounded down to 09:00.

- If an employee clocks in at 09:08, the work time is rounded up to 09:15.

To comply with FLSA rules, employers must round off employees’ work hours in a way that is neutral to or benefits them.

Calculating Overtime

Overtime pay is easy to figure out with the FLSA. Unless otherwise specified in an employment contract, the rate of compensation for overtime work is 1.5 times the standard rate of pay.

Time Tracking for Overtime-Exempt Employees

There are regulations in place for salaried workers who are excluded from overtime pay:

- Salary employees who meet the criteria for exemption from the Fair Labor Standards Act and related overtime laws must earn at least $455 per week, or $1,820 per month.

- Based on their duties and pay, salaried workers might be classified as exempt or non-exempt.

The Role of Time Tracking Apps in Compliance

While there is no rule from the federal government about how time should be tracked, it is reasonable and effective to use software or mobile apps designed specifically for this purpose. There are several benefits to using these digital resources:

FLSA Compliance: Employers can easily fulfill their record-keeping duties under the Fair Labor Standards Act (FLSA) by utilizing time tracking software. This type of software makes it simple to monitor employee time and meet legal requirements.

Error Reduction: Time monitoring tools, in contrast to traditional data entry, drastically lessen the possibility of human mistake. This improves the accuracy of employee time records and prevents both intentional and unintentional errors.

Efficiency: Keeping tabs on employees’ and managers’ working hours has never been easier than with the help of time tracking applications.

CloudApper AI TimeClock

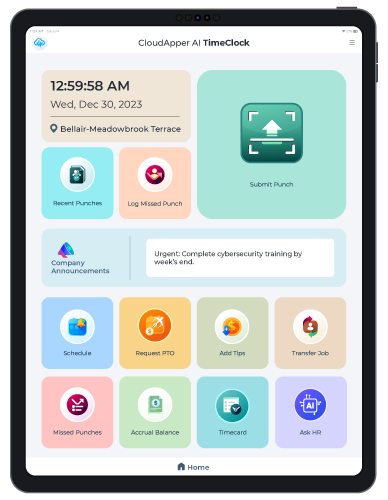

A trustworthy clock in clock out system is crucial in the United States when it comes to guaranteeing equitable pay for organized workforces. CloudApper AI TimeClock is an AI-powered solution that can be implemented to further improve the process by providing a unified HR service desk that keeps employees linked and allows for precise time monitoring. CloudApper AI TimeClock is an artificial intelligence (AI) assistant that integrates effortlessly with popular human resources (HR) and payroll (payroll) systems, responds to HR questions, and gives frontline workers more control over their own time and shifts.

In conclusion, precise and reliable time monitoring is the first step toward equitable compensation for unionized workers in the United States. Using cutting-edge tools like CloudApper AI TimeClock helps streamline this procedure, lessen the likelihood of mistakes, and improve adherence to labor rules, all of which contribute to a more just and equal workplace.

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More